We’ve worked with thousands of insurance agents to improve their marketing. We always start our conversations by asking what is already working – “How did you grow your agency to where it is now?” Through these conversations we’ve learned a variety of marketing activities that work to help insurance agents grow. Some of them are extremely basic, some are advanced. Whether you’ve been an insurance agent for 6 months or 15 years, this guide will help you discover new marketing activities you can implement to uncover quote opportunities and improve retention.

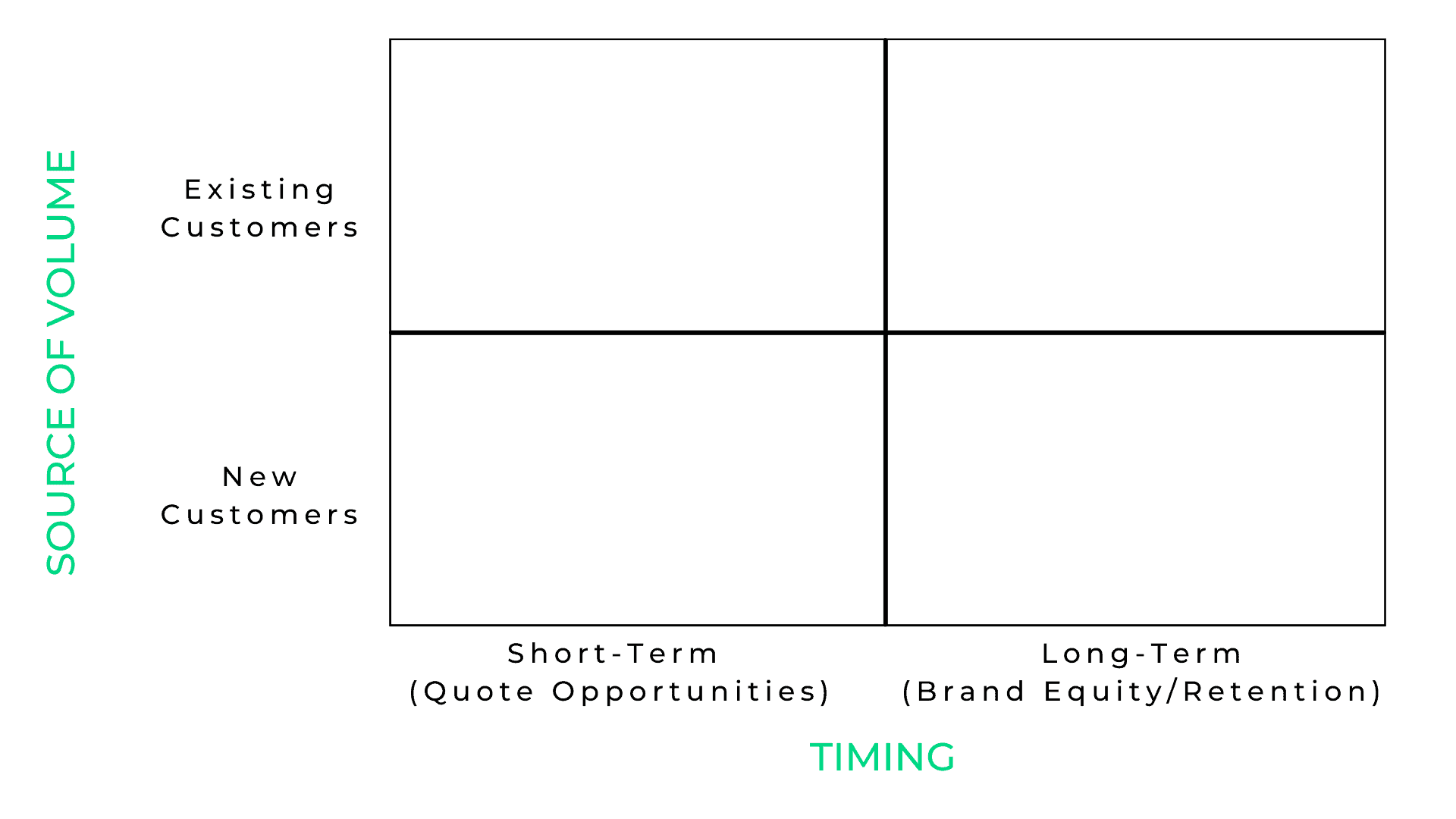

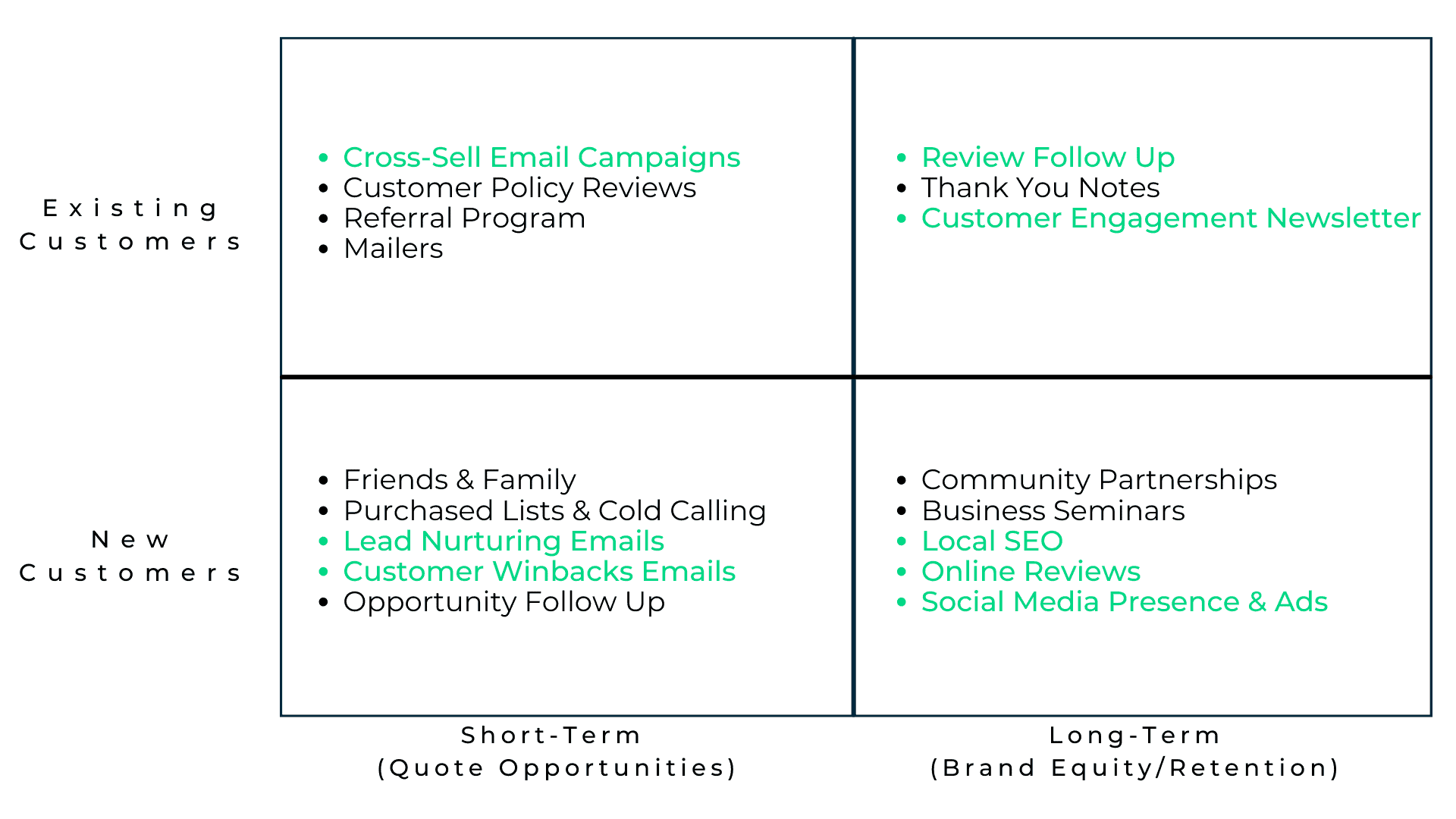

Create a Marketing Strategy: The Lift Local Four Cell Marketing Framework

At Lift Local, we developed this framework to help insurance agencies brainstorm marketing activities. It’s a simple 2×2 matrix to frame your thinking.

On one axis, we have 2 sources of volume: New Customers, and Existing Customers. Start by determining who you will try to extract value from. Some marketing activities focus on selling to new customers, while others find ways to deepen relationships with existing customers.

On the other axis we have the timing of your efforts. Some marketing activities are high-intensity and pay off in the short-term, resulting in quote opportunities immediately. Others take more of a long-term approach to plant seeds that will be harvested later, improving your brand equity or retention.

If you can brainstorm a handful of activities within all 4 boxes here, chances are you’ll have built a successful marketing strategy, and over time you’ll take off.

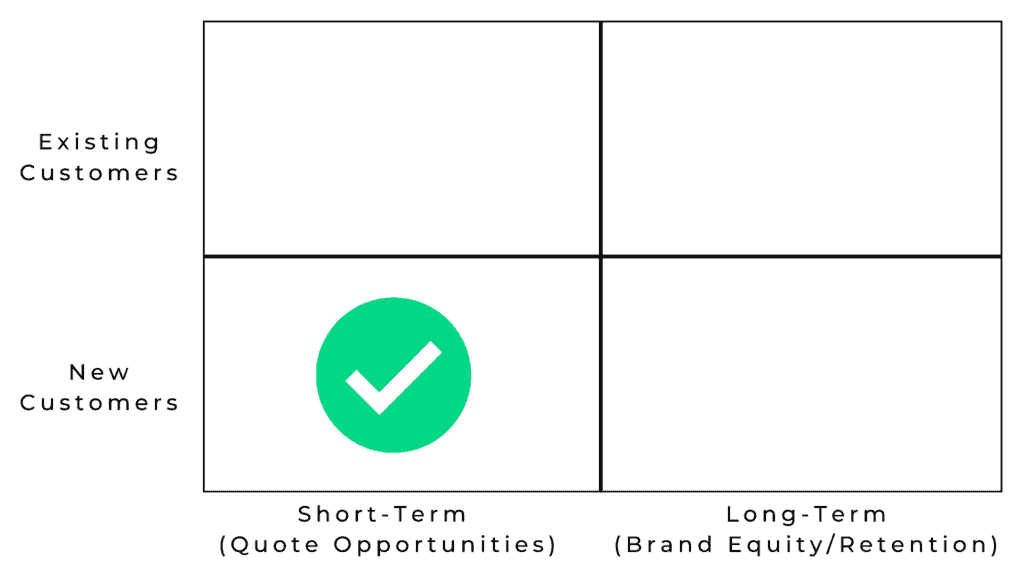

How to Get New Customers in the Short Term

1. Approach Friends and Family

1. Approach Friends and Family

This may seem elementary, but your friends and family members provide an instant, approachable group of people who are eager to support you. It’s easy to call, text or email them to offer a free insurance quote. If your sister has to have insurance on her car and home anyway, why would she not buy from you? Keep your business in mind when you’re having casual conversations with your acquaintances and be prepared to ask if they’d like an updated quote. If the quote makes sense, great! If not, no stress. Join communities where you can make new friends, such as service organizations in your community.

2. Purchase Lead Lists and Start Cold Calling

Some of the most successful insurance agents we’ve worked with have told us some form of the phrase “There’s no substitute for grinding through a cold list of leads”. Your or someone you employ at your agency needs to get comfortable making cold calls. Online vendors capture contact information of people who are actively looking for insurance, and then sell this info to agents to call on. Warm transfer leads (people who are ready to talk right now) can cost somewhere around $60-$100 each. Aged leads (a list of people who were looking for insurance info some time in the past) might cost closer to $2-$5 each depending on the quality and timing.

Many agencies have great success buying a few thousand leads and hiring a full time caller to offer quotes. A sample script might look something like:

“Hi *|PROSPECT NAME|*, This is *|YOUR NAME|* and I’m an agent with *|CARRIER OR BUSINESS|*. I noticed that you requested information about *|INSURANCE TYPE|* online in the past. I know many people are concerned about saving money right now and I’d love to get you a quick quote to see how we compare with your current insurance rates. Do you have 5 minutes so I can run that for you and see if we can save you some money? Great! I’ll just need a little information…”

3. Lead Nurturing Email Campaigns

If you’re purchasing lists, one of the primary struggles is being able to identify who’s actually ready for a quote, and contacting them at the right time. Email nurturing automates your touchpoints and ensures that you’re in their inbox with an offer when the time is right. At Lift Local, we run lead nurturing campaigns for our clients and over time, we see an average of 4-5% of the leads request a quote. If you’ve got a database of thousands of leads, that could be a significant boost for you.

4. Former Customer Winback Email Campaigns

The average customer churn rate in the insurance industry is 10-15%. After a few years in business, you’ll have quite the list of cancelled customers. Reaching out to them with nurture emails can warm them back up to do business with you again. Similar to lead nurturing, creating a winbacks nurture email campaign with your former customers creates the touchpoints needed to win them back. At Lift Local, we see nearly 10% of our clients’ former customers request an updated quote.

5. Old Opportunity Follow Up

Do you close 100% of the opportunities you quote? Of course not. Sometimes you just can’t get ahold of your prospects at the right time. Periodically it can be beneficial to call back through your list of old unclosed opportunities and try again. Make sure you’re given adequate effort to each with multiple calls and phone calls at different times of the day.

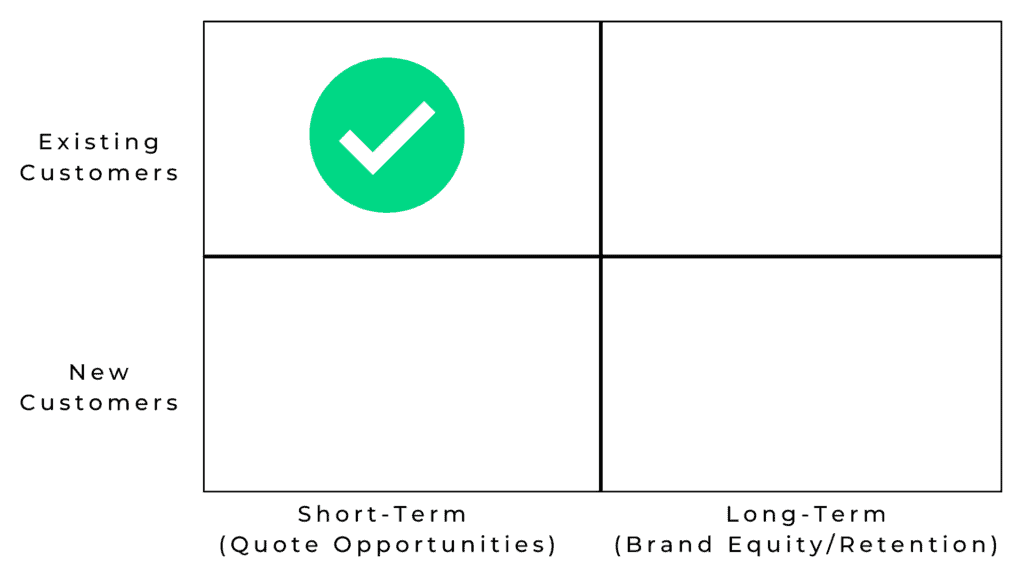

How to Extract Value from Existing Customers in the Short Term

6. Customer Policy Reviews

6. Customer Policy Reviews

One of the best approaches you can take to improve customer relationships is to be a genuine educator, mentor, and advisor. Every 1-2 years, it makes sense for an insurance customer to review their policies with their agent to ensure no unnecessary risk exposure. What might have changed? Did the value of their home increase? Do they have a child who will start driving soon? Had a baby? Etc. All of these circumstances will require an adjustment to their policies to make sure they’re properly covered.

Meet with every customer in your book and review their policies. Doing so creates an excellent customer experience for them, and uncovers potential cross-sell opportunities for you. It’s one of the most reliable sources of new business.

7. Set Up a Legitimate Referral Program

Implement a referral program and ask all of your customers for referrals. Whenever you interact with them, ask for referrals. Send them an email campaign to present your referral program.

8. Mailers

Send mailers to your existing customers and let them know about the other services you offer, or discounts that might be available to them. Make sure to include an easy way for them to contact you, like a QR code to your webpage and your phone number.

9. Cross-Sell Email Campaigns

Do you know which of your customers are in need of a specific product? Mass email those people with your pitch. For example, get a list of your homeowners policy holder without auto insurance with you and send them a few emails to offer them a quote and a bundling discount.

Get Insurance Marketing to Get More Quote Requests

Our marketing campaigns set you up for success by helping you start more conversations with prospective, current, and former customers to uncover sales opportunities and improve retention.

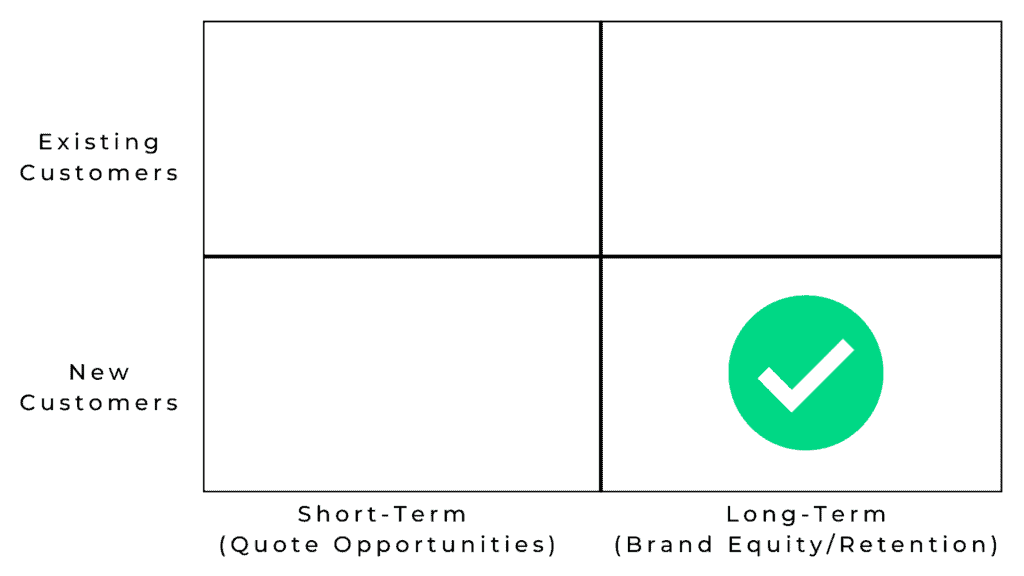

How to Sell New Customers in the Long Term

10. Community Partnerships

10. Community Partnerships

A fundamental question of marketing is “Where are my customers when they need my products, and how do I reach them there?” Auto dealers, real estate agents, mortgage brokers, and other service professionals have access to people who need auto and home insurance. Build relationships with these professionals in your community. Take them out to lunch and create partnerships to send each other referrals. Referrals from these sources are extremely valuable.

11. Business Seminars

Visit businesses and offer to do a free seminar to teach their employees about insurance options like life insurance or financial planning.

12. Local SEO

Google searches for “insurance near me” have more than doubled in the past 2 years. People are looking for insurance on Google, and if your agency finds a way to show up at the top of the local seach rankings, you’ll capture more customers. Start with your Google Business Profile. This article walks you through how to get started with optimizing your profile to rank higher.

13. Online Reviews

When people are searching for insurance online, they often go with the provider with the best reviews. Create a process to reliably get positive reviews from your customers. Read more here.

14. Social Media Presence and Ads

Your social media presence helps buyers know that you are credible. Posting weekly and engaging with users makes your page look legitimate. Running ads on social media can get you message in front of members of your community who don’t follow you yet.

How to Extract Value from Existing Customers in the Long Term

15. Review Follow Up

15. Review Follow Up

If you’re asking your customers for reviews as a long-term reputation strategy, you’ll have feedback from your existing customers. Call satisfied customers to thank them for their positive feedback. These conversations will naturally lead to you finding new upsell and referral opportunities. Call unhappy clients and resolve their concern. Build long-term relationships with all customers. This will improve retention.

16. Thank You Notes

Whenever you write a new policy, send a hand-written thank you note to the new customer to start the relationship on the right foot.

17. Customer Newsletter Emails

Send a monthly email to your current clients to educate them, build a relationship, uncover service opportunities, and ultimately, improve retention.

A Complete Marketing Strategy

You Work on These Activities

We can Handle These for You

Friends & Family

Purchsed Lists & Cold Calling

Opportunity Follow Up

Community Partnerships

Business Seminars

Customer Policy Reviews

Referral Programs

Mailers

Review Follow Up

Thank You Notes

Get Marketing Help from Lift Local

Fill out the form and our team will reach out to set up a 15-minute demo.