If you’re an agency owner looking to improve your marketing, chances are you’ve stumbled upon dozens of articles packed full of half-baked marketing ideas. You’re left with one paragraph’s worth of instruction on a topic you know little about, and maybe 3 or 4 of the 20 ideas listed feel feasible for you. Does that sound familiar?

The key to building a full marketing strategy is to understand the purpose and function of marketing. At Lift Local, we center our approach to insurance marketing around the marketing funnel and we want to empower you to come up with your own marketing activities. These 5 questions will help you brainstorm marketing activities that will move potential customers through the marketing funnel and into your book of business.

1. How can I get my message in front of potential customers to make them aware of my brand and the problems I can solve?

2. Where do my potential customers search for solutions, and am I present in those places?

3. How do I stand out from competitors and why should potential customers pick me?

4. How can I make it easier or more convenient for people to contact me and do I have a reliable follow-up process?

5. What can I do to build a relationship with customers (improve retention) and how do I maximize the value of each one (up-sell & cross-sell)?

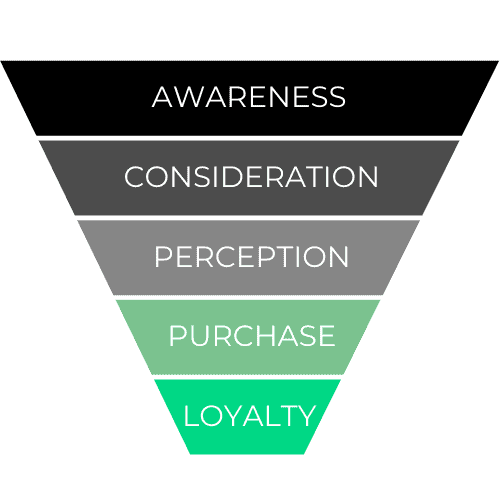

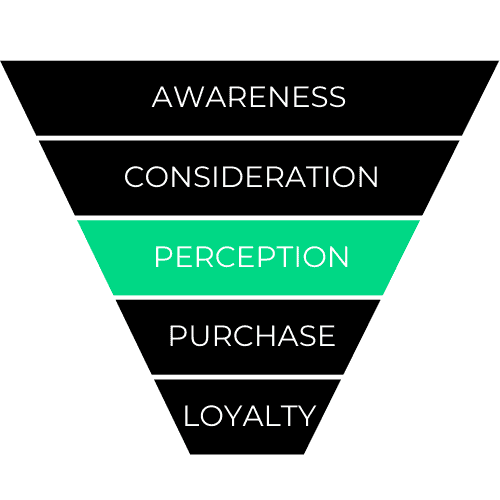

The Marketing Funnel

The marketing funnel is a model used to illustrate the steps a customer takes in the purchase journey. It’s called a funnel because it starts wide at the top (many people are in the market for insurance) and narrows with each step because not everyone who is in the market for insurance will end up purchasing from you. The funnel helps highlight marketing opportunities that increase the number of customers who move from one stage to another to ultimately maximize the number of people who purchase. You’ll need to have every step of the funnel covered to have an effective marketing plan.

At each step of the funnel, we’ll provide you with a brainstorming question that will help you come up with ways to reach potential customers in that particular phase of the funnel. At the end of the 5 questions, you’ll have an actionable marketing plan to implement at your agency.

Question 1. Awareness

- 1. How can I get my message in front of potential customers to make them aware of my brand and the problems I can solve?

The awareness stage of the marketing funnel is not about closing sales. It’s simply about planting seeds, so to speak. You’re just trying to help people realize that there is a problem that they should be concerned about and you’re trying to get them to remember your brand. Why are your insurance products important? What is the problem you can solve for your customers? What’s memorable about your agency?

Some ideas that might come to mind might be things like:

- Postcard Mailers

- One-pager insurance product explanation handouts

- Facebook Ads

- Billboards

- Event or Team Sponsorships

- Radio Ads

Remember, the message of all of these tactics should be focused around helping people become aware of their problem, the solution, or simply to generate brand recognition.

Awareness Examples:

This Facebook ad simply brings awareness to the fact that a home fire without proper insurance could be financially catastrophic:

This billboard from a Florida insurance agent is simply getting his name out there:

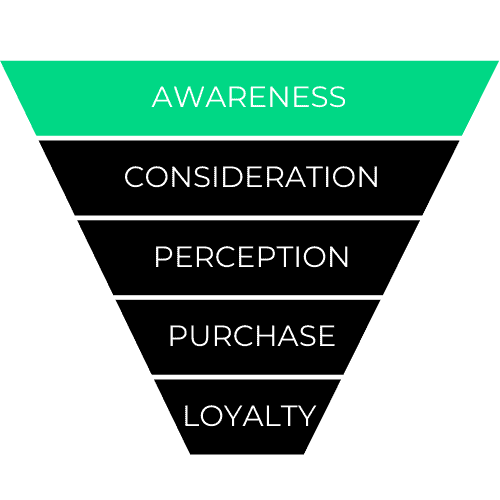

Question 2. Consideration

- Where do my potential customers search for solutions, and am I present in those places?

The consideration phase of the marketing funnel represents when potential customers are aware of a problem and begin searching for solutions. They are considering which possible option they will purchase. Marketing activities at this stage of the funnel are all about being present in the right place at the right time. When your potential customers are looking for insurance, are you there? Can they choose you? Are you even an option?

Some ideas that might come to mind are:

- Partnerships with realtors, mortgage brokers, or car dealerships (you might ask your partners to distribute your handouts you created as part of the awareness phase)

- Referral reward programs

- Google optimization

Again, the major principle here is to be present where your potential customers are looking!

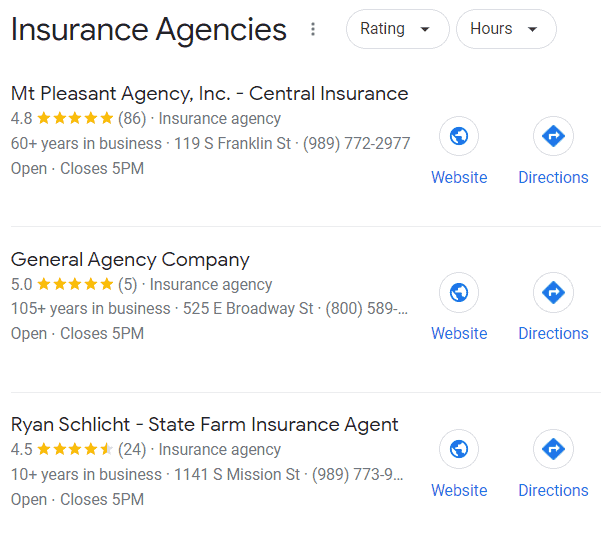

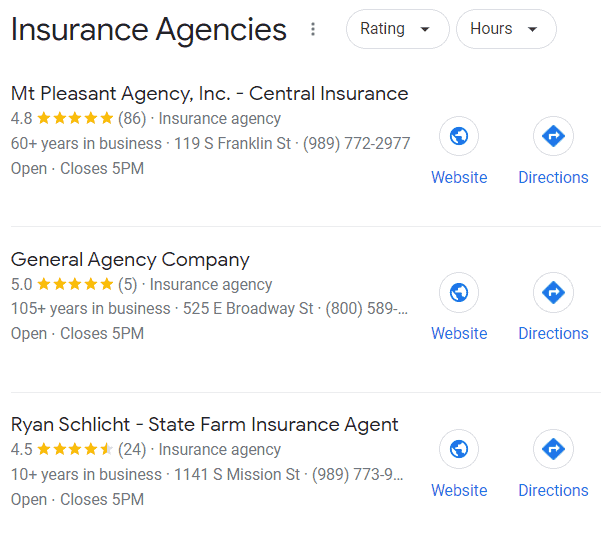

Consideration Examples:

When users search for insurance online, their consideration set is limited to whatever businesses show up in the search results. A solid Google presence gets your business into the consideration set.:

Leaving your business cards with partners allows them to quickly and easily get potential customers to consider you as an option.

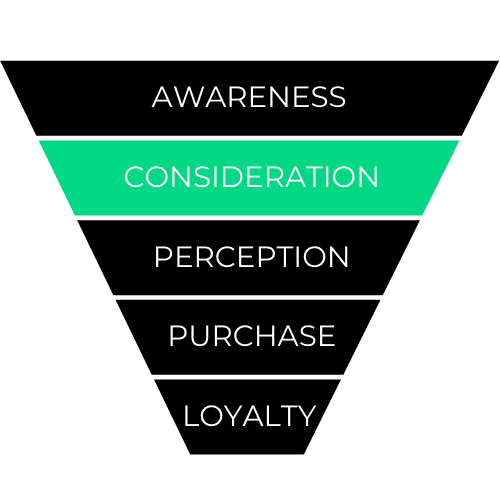

Question 3. Perception

- How do I stand out from competitors and why should potential customers pick me?

The perception phase of the marketing funnel is all about looking good. Once the customer has narrowed down their options during the consideration stage, what makes you stand out? How can you improve customers’ perception of you once you are in their consideration set?

Some ideas for this stage might include:

- Customer Reviews (huge for online presence)

- Relevant messaging

- Style/Branding

Perception Example:

If this was your consideration set, which agent would you choose and why? The one with the most, highest reviews, right?

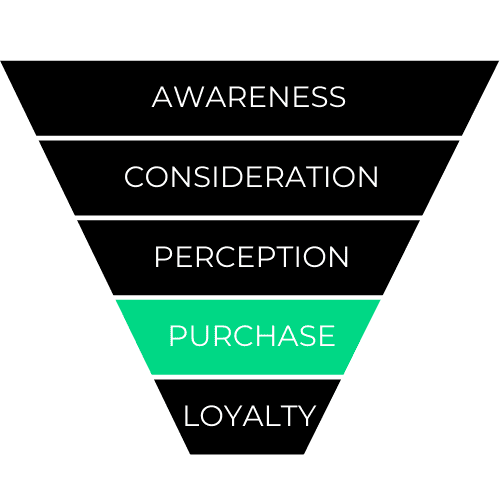

Question 4. Purchase

- How can I make it easier or more convenient for people to contact me and do I have a reliable follow-up process?

The purchase phase of the marketing funnel focuses on making it as easy as possible for potential customers to move through your sales process. Is your contact information readily available? Do you have a staff member fielding inbound calls? Do you have a process in place to follow up with missed calls or emails? Just make sure you’re not letting people fall through the cracks.

Some ideas for creating a pleasant purchase process might include:

- Sales call lunches (take your potential customers out to lunch to close the sale)

- Contact information listed on your Google profile

- Online chat

- Auto-quote tool

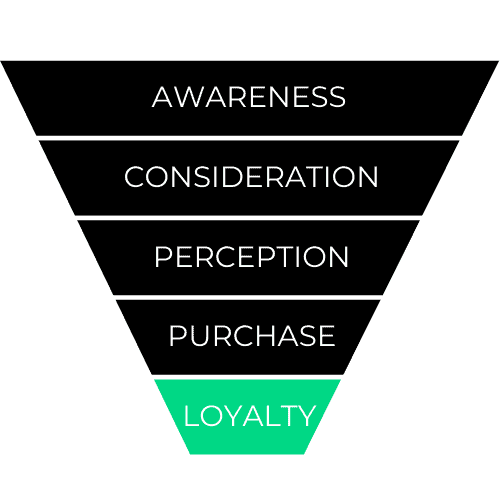

Question 5. Loyalty

- What can I do to build a relationship with customers (improve retention) and how do I maximize the value of each one (up-sell & cross-sell)?

Once you’ve closed a sale, what’s next? The average insurance agency experiences a 16% turnover rate. Any efforts to improve that retention rate will boost your profitability. So many agents simply let their customer relationships wither and die once the sale is closed – personal relationships are key!

Ideas:

- Annual insurance review meetings

- Customer appreciation pool party

- SWAG

- Email newsletters

- Social media engagement

It turns out you can build a pretty robust strategy by answering 5 questions.

1. How can I get my message in front of potential customers to make them aware of my brand and the problems I can solve?

2. Where do my potential customers search for solutions, and am I present in those places?

3. How do I stand out from competitors and why should potential customers pick me?

4. How can I make it easier or more convenient for people to contact me and do I have a reliable follow-up process?

5. What can I do to build a relationship with customers (improve retention) and how do I maximize the value of each one (up-sell & cross-sell)?

An example of a plan might look something like this:

- Send mailers with my picture, business name, slogan,and product offering to my home zip code.

- Complete my Google Business Profile so I am shown in the search results when users search for insurance.

- Generate new Google reviews from my customers so I have a better review profile than my competitors in the Google search results.

- Create a standard sales follow-up process to ensure we get in contact with every quote request, even if we miss their first call.

- Start a monthly customer newsletter.

Actionable marketing strategies are more intuitive than you might think. At Lift Local, we have services that help you start conversations with potential, current, and former customers at every stage of the marketing funnel. If you’re interested in getting a little help building a strategy that fits your agency, don’t hesitate to reach out!