Growth for insurance agencies can come in two ways: increasing premiums and reducing churn. Both of which benefit form understanding your customers, which is why a well-designed feedback process is an essential tool for any insurance agent. Here’s how gathering and acting on customer feedback can help you grow.

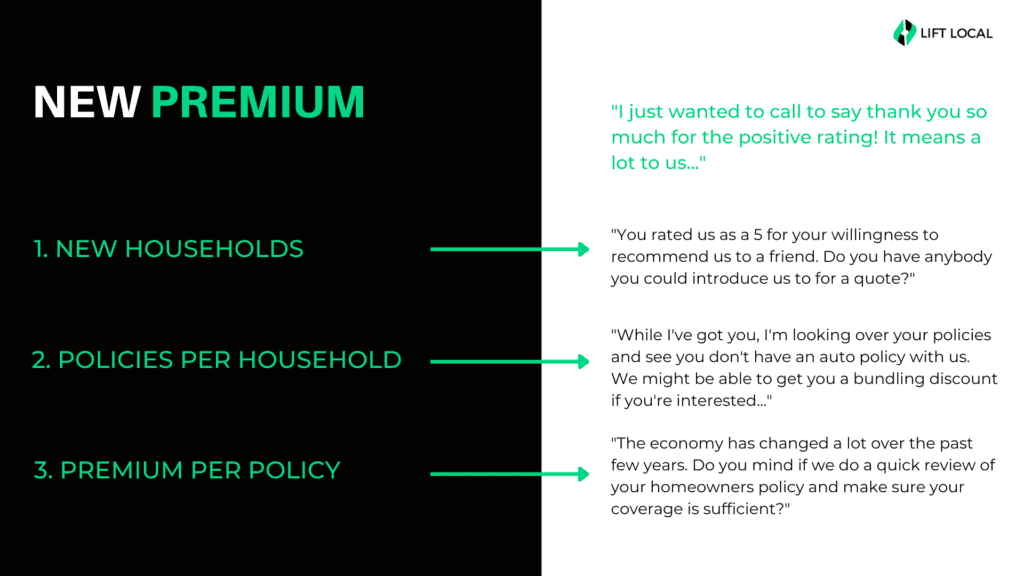

Increasing Premiums

There are 3 ways to increase your premium written:

- Adding New Households

Attract new clients and sell them policies. - Cross-Selling to Current Clients

Increasing your number of policies per household by offering additional products—like adding home insurance to an auto policy—helps deepen your relationships and secure more business. - Upselling for Higher Premiums

Encourage clients to opt for larger or more comprehensive policies. For instance, upgrading to a policy with higher coverage limits can increase both their protection and your premium revenue.

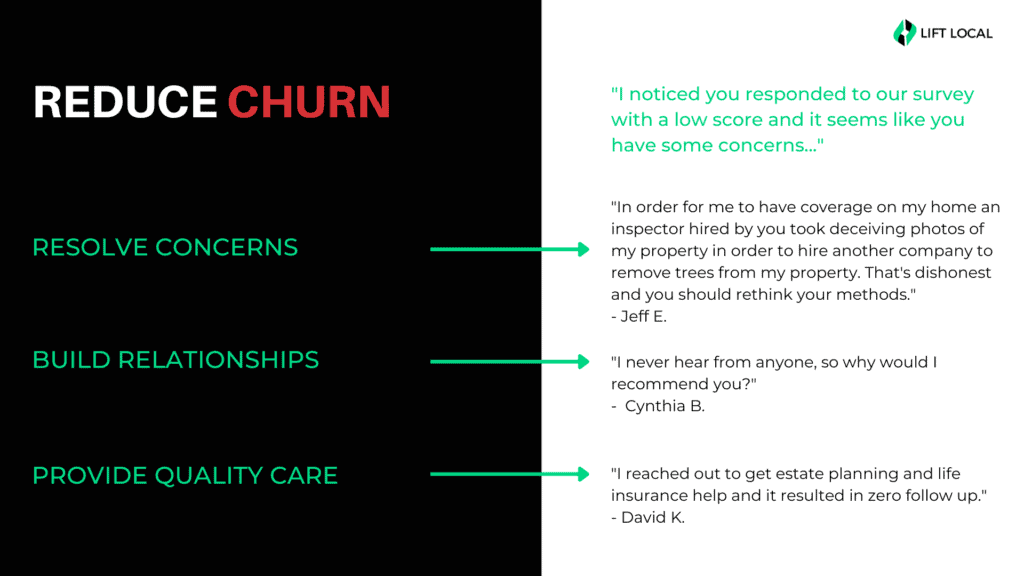

Reducing Churn

Customer retention is just as vital as acquiring new clients. It’s tough to build a valuable book of business when you have revenue leaking out the bottom of your bucket, so to speak. A loyal customer base provides consistent revenue through renewals. To reduce churn, focus on:

- Providing a Great Customer Experience

Happy customers are more likely to stay. Ensure their concerns are heard, problems are resolved, and relationships are nurtured. - Building Trust

Regular, positive interactions foster loyalty, making clients less likely to switch providers. - Resolving Concerns

If concerns do arise, be quick to resolve them. Showing a customer that they matter to you, and that their concerns are accounted for, can help save customers that might otherwise churn.

Why Feedback Matters

A structured feedback process reveals actionable insights into how to make the most of your satisfied and dissatisfied customers . Here’s how it works:

- Capitalizing on Satisfied Customers

Happy clients are prime candidates for cross-selling, upselling, and referrals. For example, upon receiving positive feedback, you might reach out with a thank-you call. While on the call, review their policies and suggest opportunities to bundle or enhance coverage, such as adding auto insurance for a discount. You can also use this call to ask the customer for any referrals that you can reach out to. Here are some examples of the ways your conversations with satisfied customers might lead to increased premium.- New Households -> “You rated us as a 5 for your willingness to recommend us to a friend. Do you have anybody you could introduce us to for a quote?”

- Policies per Household -> “While I’ve got you, I’m looking over your policies and see you don’t have an auto policy with us. We might be able to get you a bundling discount if you’re interested…”

- Premium per Policy -> “The economy has changed a lot over the past few years. Do you mind if we do a quick review of your homeowners policy and make sure your coverage is sufficient?”

- Saving Dissatisfied Customers

Negative feedback helps you catch and address issues before they escalate. If a client reports a problem, such as lack of follow-up on a life insurance inquiry, resolving it promptly shows your commitment to their satisfaction and might prevent them from leaving when their renewal comes up. Here are some examples of real feedback our clients have received from their feedback campaigns. It’s not hard to imagine how you could potentially follow up with these dissatisfied customers to resolve their concerns:

- “I never hear from anyone, so why would I recommend you?”

- “I reached out to get estate planning and life insurance help and it resulted in zero follow up.”

- “In order for me to have coverage on my home an inspector hired by you took deceiving photos of my property in order to hire another company to remove trees from my property. That’s dishonest and you should rethink your methods.”

Your Feedback Process

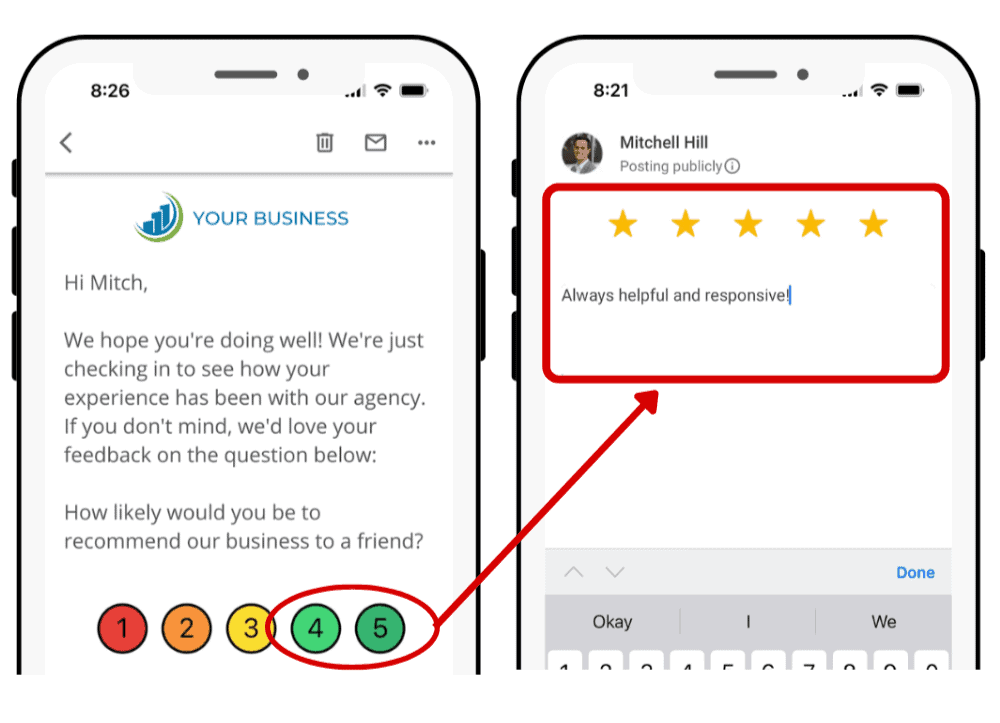

There are a variety of ways you could go about receiving feedback from your customers. The best process will be one that is automated, and reaches clients at a variety of stages in their lifecycle (not just at renewal or closing).

At Lift Local, we’ve developed a streamlined feedback system that’s easy to implement and highly effective. Our process:

- Automated Email Surveys

Customers rate their experience on a simple 1–5 scale.

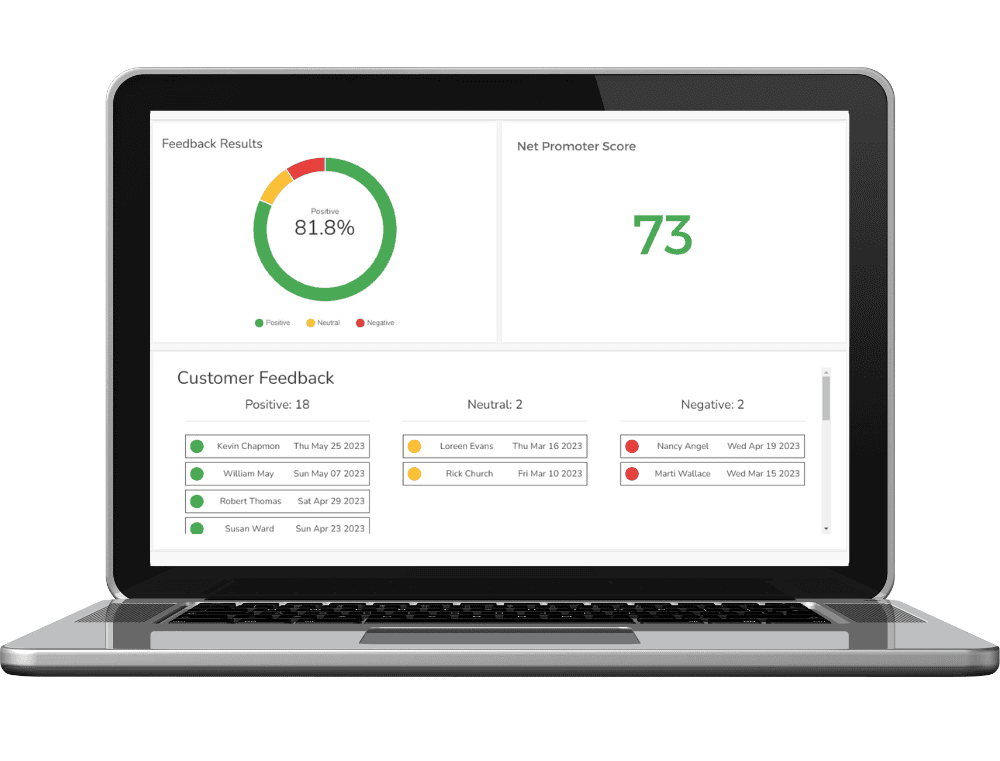

- Real-Time Dashboards

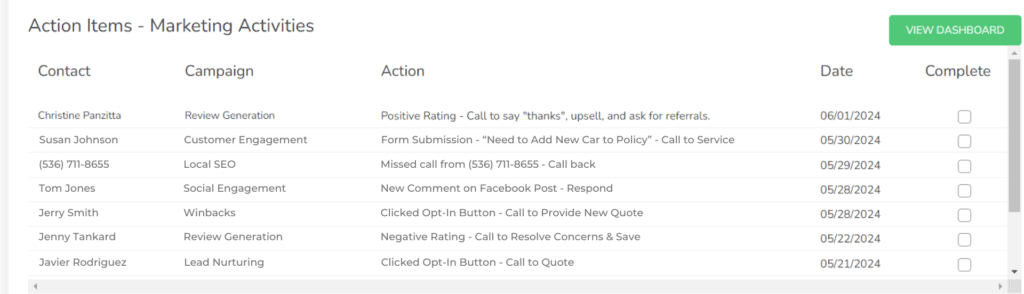

Ratings are recorded in a dashboard, allowing agents to quickly see who’s satisfied and who isn’t.

- Data-Driven Actions

All this information becomes various action items displayed on our action items dashboard. Use these action items to target satisfied clients for sales opportunities and engage dissatisfied clients to address their concerns.

Turning Feedback into Growth

An intentional feedback process doesn’t just improve customer relationships—it’s a growth engine. By knowing who’s happy and who isn’t, you can make informed decisions that:

- Drive revenue through upselling and cross-selling.

- Improve retention by addressing client concerns early.

- Strengthen your reputation and increase referrals.

With a focus on feedback, your agency can unlock its full growth potential, ensuring long-term success in an ever-evolving market.

Ready to leverage feedback for growth? Start building a better process today and watch your agency thrive