For many insurance agencies, one of the major hurdles to doing quality marketing is the difficulty of learning the skills and techniques required. It’s hard to know exactly what you’re supposed to do! There can be uncertainty around costs, time commitment, and technical expertise. Here we’ll outline some basic foundational marketing activities that you can implement today! They’re mostly free (or cheap) and easy to get started.

1. How to Get More Inbound Calls from Google – Local SEO

Search Engine Optimization (SEO) is the practice of optimizing your website to appear higher in search results. Many insurance agents have tried and been burned by SEO companies in the past. That’s because traditional SEO is not effective for individual insurance agents. There’s a better way.

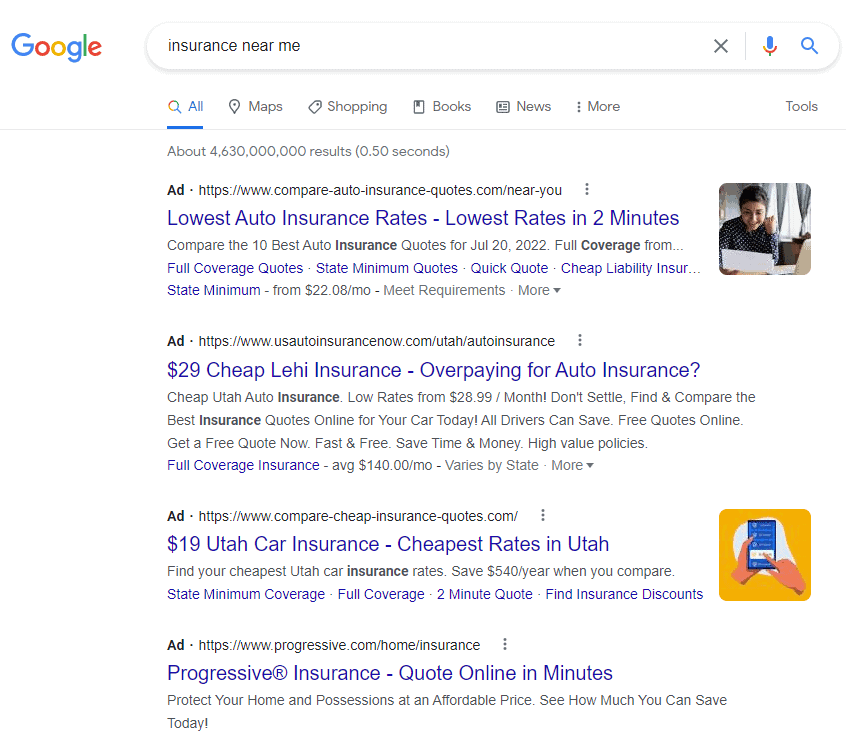

Local SEO is the practice of optimizing your business information (specifically your Google Business Profile) so that you appear higher in the LOCAL search results. When you do a Google search for “insurance near me” you’ll find the following results:

First, you’ll see 3-4 ads at the top of the page. These are businesses who literally pay Google to show them at the top. It’s expensive and difficult to get Google ads right. Most users scroll right past the ads.

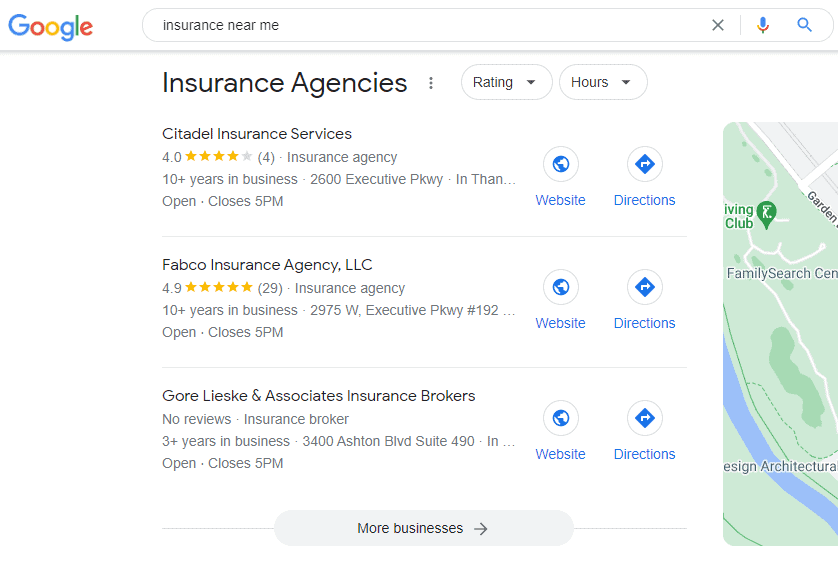

Next, you’ll see 3-4 businesses listed next to Google’s map feature. These are the LOCAL SEO results. Google lists business profiles for relevant businesses in the area, which includes a variety of information about the business. Take note of what kinds of businesses are listed here: they’re individual, local businesses – agencies like yours. Agencies you could compete with.

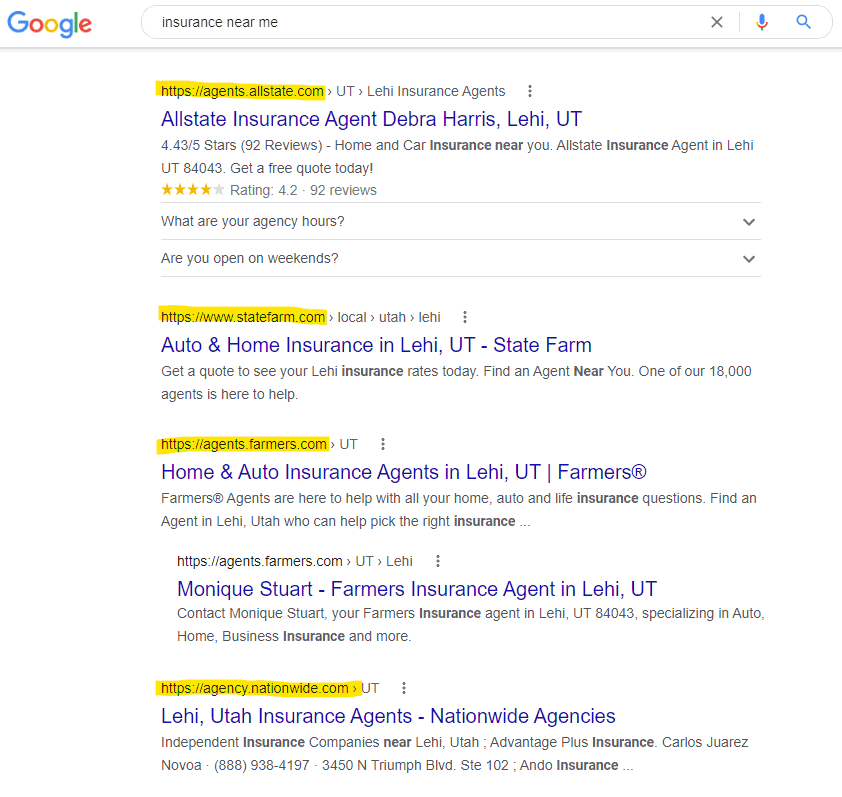

Last, you’ll see the organic search results. These are links to formal websites. The goal of traditional SEO is to appear in this section of the search results. Take note of what kinds of pages are ranked here: I’ll bet that when you search for “insurance near me”, the top organic results will include mostly corporate insurance carrier pages like Farmers, State Farm, All State, Nationwide, and others. These are billion-dollar companies with massive marketing budgets and full teams devoted to SEO. They are huge and Google knows it. Your individual agency will not be able to compete with these corporate behemoths, which is why most traditional SEO strategies fail to produce results.

So, if you want to get new business from Google, you should focus on Local SEO because you’ll appear higher in the search results than if you focused on traditional SEO for your website, and because you can actually compete for a ranking position locally. Plus it’s relatively easy to implement. Here’s how:

How to Get Started with Local SEO

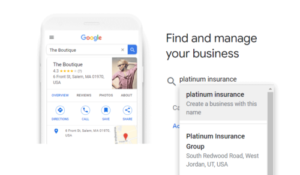

First, you’ll need to claim your Google Business Profile. This profile is where you’ll enter the information that Google will show on the map section of the search results. Navigate to business.google.com and sign in with your Google account. Once logged in, you can search for the name of your business. If a Google Business Profile already exists, you can claim the business. If not, you’ll just need to enter some basic information to get your profile set up. Google will usually require some level of verification. Most commonly, they’ll send you a physical postcard with a verification code to the address you entered as your business location. When you receive the postcard, log back into business.google.com and enter the code. This will verify your listing so you can start being shown in search results!

First, you’ll need to claim your Google Business Profile. This profile is where you’ll enter the information that Google will show on the map section of the search results. Navigate to business.google.com and sign in with your Google account. Once logged in, you can search for the name of your business. If a Google Business Profile already exists, you can claim the business. If not, you’ll just need to enter some basic information to get your profile set up. Google will usually require some level of verification. Most commonly, they’ll send you a physical postcard with a verification code to the address you entered as your business location. When you receive the postcard, log back into business.google.com and enter the code. This will verify your listing so you can start being shown in search results!

Once you’ve claimed and verified your profile, log back into business.google.com and enter as much accurate information as possible about your business. Don’t forget to utilize the services, products, and photos sections. This arms Google with information about your business so it can match you to relevant searches.

Now when people in your area search for services like yours, you’ll have a chance to capture their interest and potentially receive some inbound leads.

2. How to Make the Most of Social Media – Engaging & Boosted Posts

For well over a decade, you’ve probably been hearing how essential it is for businesses to be active on social media. The truth is, most local businesses get next to no value from posting regularly on social media. Most insurance agencies struggle to get followers, and even the ones who do have a hard time driving any sort of meaningful engagement. That’s because social media algorithms prioritize posts that are likely to get likes, comments, and shares, and to be frank, insurance-related content isn’t doing that.

To be more effective on social media, we’d recommend this simple strategy. First, brainstorm posts for the following categories:

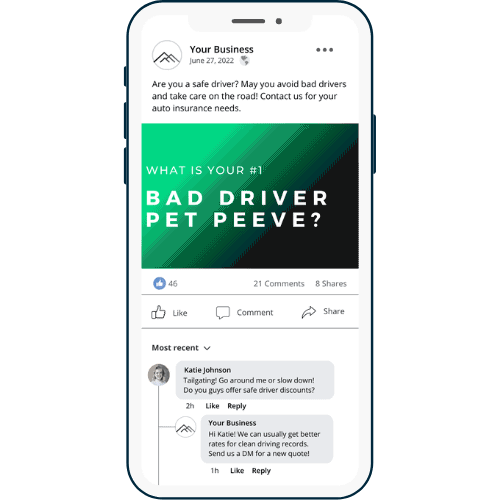

- Posts that are vaguely related to insurance, but that are highly engaging. Here are a few examples: “What is your bad driver pet peeve?” This post can be related to safe driving and car insurance, but mostly invites people to vent their road rage! People will comment on this post. Another example might be: “Tell us about the most extreme storm you’ve ever lived through”. Again, this post has ties to home insurance, but is mostly just engaging.

- Posts that are directly promotional. Things like “Are you paying too much for your auto insurance? I’d love to run a new quote for you”. This post will link to the “Contact Us” or direct quote page on your website. You could also create a post angled at bundling discounts.

For each post concept that you come up with, you’ll want to create a visual graphic with the main question in bold text. You’ll need to include a call-to-action as well (i.e. “Contact us for a new quote!”).

Once you’ve created your posts, plan to post them about once per week. You’ll find that your posts alone will get very little interaction, so here’s the real trick: Facebook and Instagram have the option to “Boost a Post”. Basically what this means is you’ll put some budget behind the post to run it as if it was an ad. You’ll choose your target audience and your budget and then the social media platform will prioritize showing your post to people you’ve targeted. We recommend that most insurance agents just target a 20 mile geographical radius around their office address, without attempting to specifically narrow it down to people interested in buying insurance. This will get your name and engaging post in front of people in the local community. We’ve found that running the post for 5-10 days with a $50 total budget is plenty to boost your engagement.

Boosting engaging posts can get your brand in front of several thousand members of your community who otherwise would never have heard of you. As you continue to boost posts month after month, and users comment on your posts, you’ll need to be sure to engage with them! Respond to comments. Start conversations with people about their lives and needs. Your reputation will start to grow and people will start to turn to you for insurance.

3. How to Get More Online Reviews (and Turn Them into Productive Conversations)

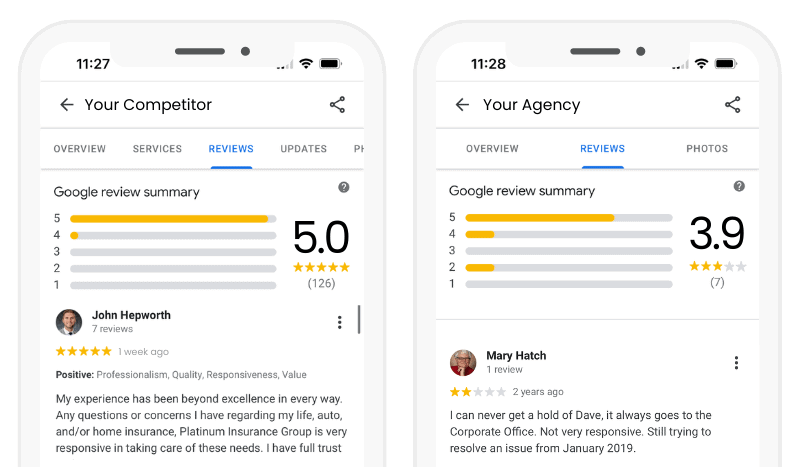

92% of consumers say they consider online reviews before making a purchase decision, and 83% say that reviews must be relevant and recent to be trustworthy. If your competitors have better reviews than you, they’ll be the ones who get calls from potential customers. Having strong online reviews is an integral part of a digital marketing plan.

To get more reviews, you can log into your Google Business Profile account. On the home page, there is a link to get more reviews. Click the button that says “Share Review Form”. You can send this link to any of your customers or friends, and it will take them directly to the page where they can write you a public Google review. As you make plans to seek more reviews, consider a few recommendations:

- Aim to get 3-5 reviews consistently each month. Consumers and Google like to see that you are consistently doing quality business. A few reviews on a monthly basis will be much more helpful for your brand than 20 new reviews in one month and then nothing for the rest of the year.

- Try to get reviews from customers who are at different stages of their relationship with you. Some should be at the time of purchase, while others might be insightful when you’ve been serving them for many years.

Seek feedback from satisfied and dissatisfied customers. Obviously, you don’t want unhappy customers to leave you a review, but it can be extremely valuable to periodically check in on all clients and try to find out what you can do better.

Once you’re receiving review and feedback, don’t forget to respond. Customer feedback is helpful for identifying opportunities to save unhappy customers and up-sell happy ones.

4. How to Use Email Marketing to Find Prospects to Talk to

The average lead has 6-8 touch points with a business before becoming interested in a sales conversation – very few prospects will be ready to close the first time you contact them! So if cold calling is one touch point, how do you create others and warm up your leads?

Email marketing is a tool that can be automated to make sure your prospects are hearing from you on a consistent basis. You can write multiple emails with information you’d like your prospects to know, and schedule them to send over time so you can warm up your relationship with contacts and have a greater chance of success when you personally reach out.

Then, when you call through your list, you’ll have a reason to call. You can say “Hi, I sent you an email recently, and I am following up with more information about it.”. For your contacts who have viewed and opened your emails, they’ll already be familiar with your name and message. You can prioritize calling on leads who have interacted with links in your emails to make sure you’re calling the most engaged prospects first.

The first step for creating an automated email marketing campaign is to find an email sending platform. One we might recommend is Mailchimp. Mailchimp has a free option (but it doesn’t include automated sending capabilities). Their basic option that includes automated emails starts around $10 per month. It may take a little bit of time to become familiar with the platform.

Then you’ll need to come up with emails you’d like to send to your prospects. Here are some topics you could consider:

- Pricing Changes – insurance rates change all the time. Simply ask your leads if they’d like to receive an updated quote.

- Insurance Awareness – teach your leads about the basics of insurance. What are the risks of not having insurance? How does insurance work financially? Help your leads see you as an expert in the insurance space.

- Life Updates – when life changes take place, it often exposes new risks, insufficient coverage, or discount opportunities. List some common life changes, and let your leads know that if they’ve experienced one, they should contact you for a new quote or policy review.

- Bundling Opportunities – if your leads have insurance with a handful of different providers, let them know you can probably save them money by bundling their policies.

- Seasonality – Get a new quote before summer travel, holiday season, etc.

- Proper Coverage – offer to do a policy review to ensure your lead has proper coverage.

- Your Expertise – what makes your agency better than competitors? Highlight some of the things that make you special, whether it’s experience, involvement in the community, pricing, or anything else that makes you different.

For any topic you choose to write about, here are some best practices you should follow:

- Keep it short. Long emails don’t get read. Make it easy to skim by using bolding and spacing. If the email can’t be summarized in 4 sentences or less, it will likely not be effective.

- Include a Call-to-Action. At the end of every email, give your prospect a chance to demonstrate their interest level. You can ask them to give you a call, respond to the email, or click a link to your website. When you include links in your emails, your email sending platform will track who has clicked on them, which is a great indicator of who you should call.

- Use personalization. Your email platform will have the capability of including the email recipient’s first name if you’ve uploaded that in your audience. This makes the email more personal and less spammy.

Once you’ve written your emails, schedule them to consistently send over time. We’d recommend sending a fresh email every 2 weeks or so. Then follow up! Make sure you’re regularly calling the same list you’re emailing. This multi-channel method will produce better results than either channel alone.

Hopefully this list gives you some clearer action items for how to get started with digital marketing at your insurance agency. If you have any questions or need some help, feel free to reach out to us!