In the highly competitive world of insurance, marketing strategies often revolve around lead generation, brand visibility, and customer retention. However, one of the most effective and often overlooked approaches is making the primary goal of your marketing efforts to generate as many productive conversations as possible. Your insurance expertise and sales skills can uncover a goldmine of new quote and retention opportunities if you know how to use them. By prioritizing engagement and meaningful interactions, insurance agents can ultimately drive growth and success.

The Power of Conversations in Insurance Marketing

Marketing campaigns are typically designed to increase brand awareness, drive website traffic, and generate inquiries. While these objectives are important, the real value lies in converting interactions into productive conversations. Whether it’s through inbound calls, customer feedback, or engagement campaigns, each conversation presents an opportunity to quote new prospects, retain existing clients, and enhance customer relationships.

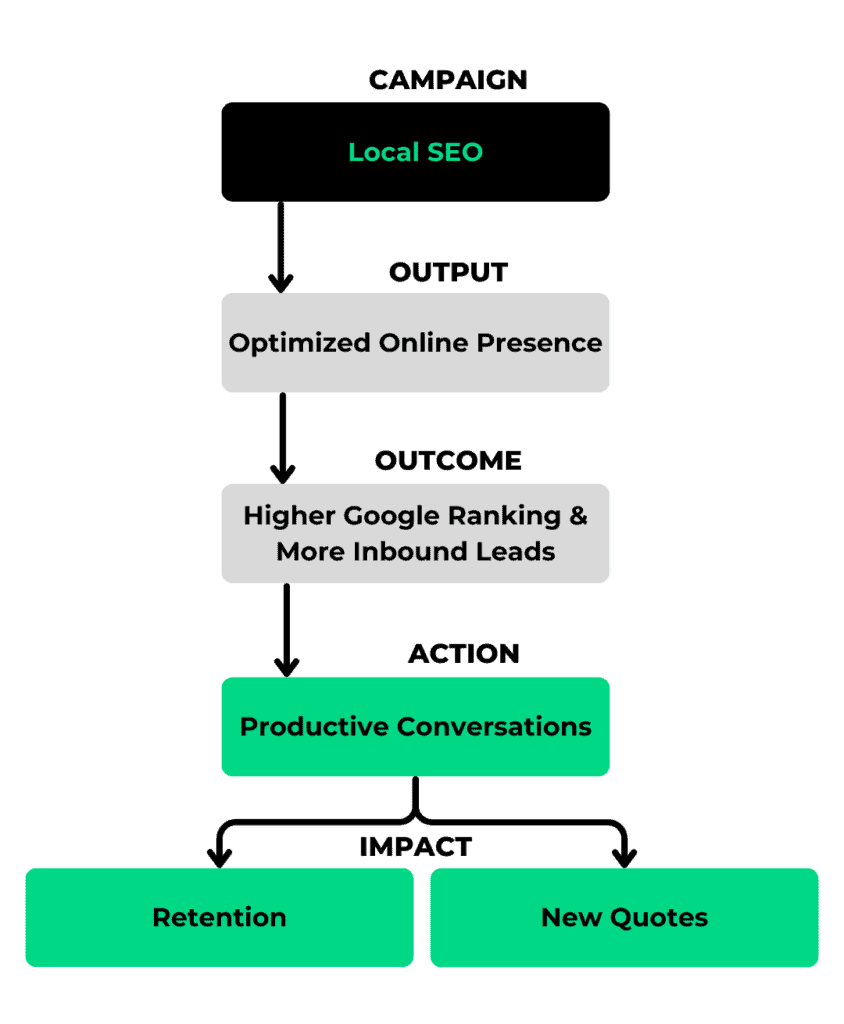

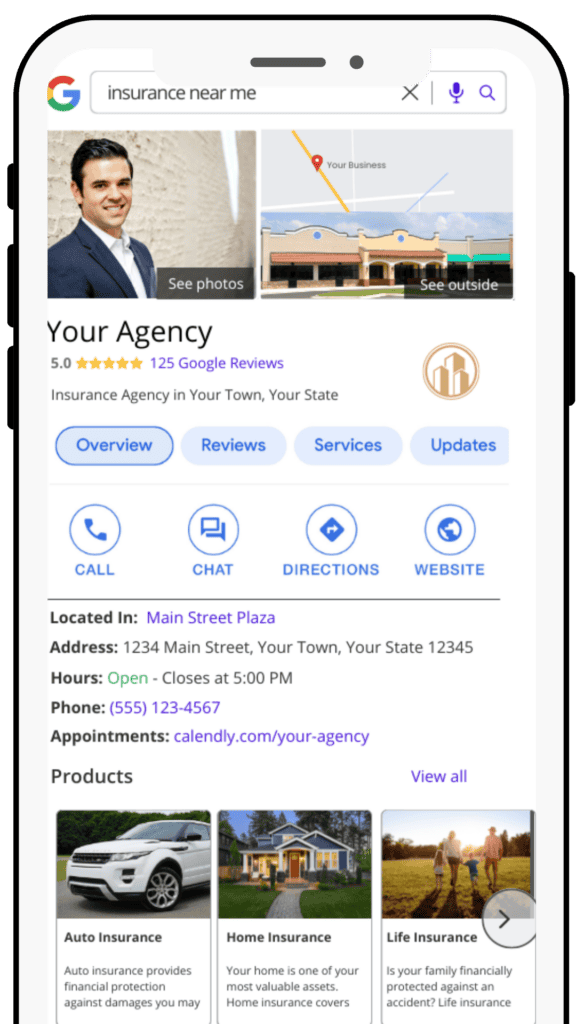

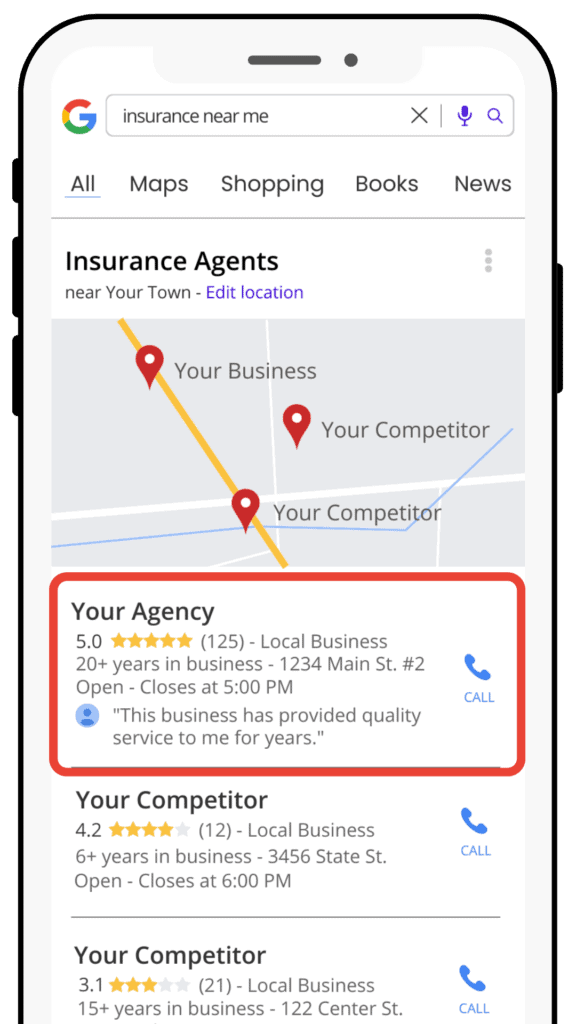

1. Local SEO: Generating Inbound Calls

A well-optimized online presence through local SEO naturally leads to more inbound calls. By having a Google Business Profile that stands out, maintaining active social media profiles, and ensuring directory listings are up to date, your agency can attract more inquiries. Some of these calls will come from potential new customers seeking quotes, while others will be from existing clients. Engaging with both groups allows for quote opportunities and strengthens customer retention.

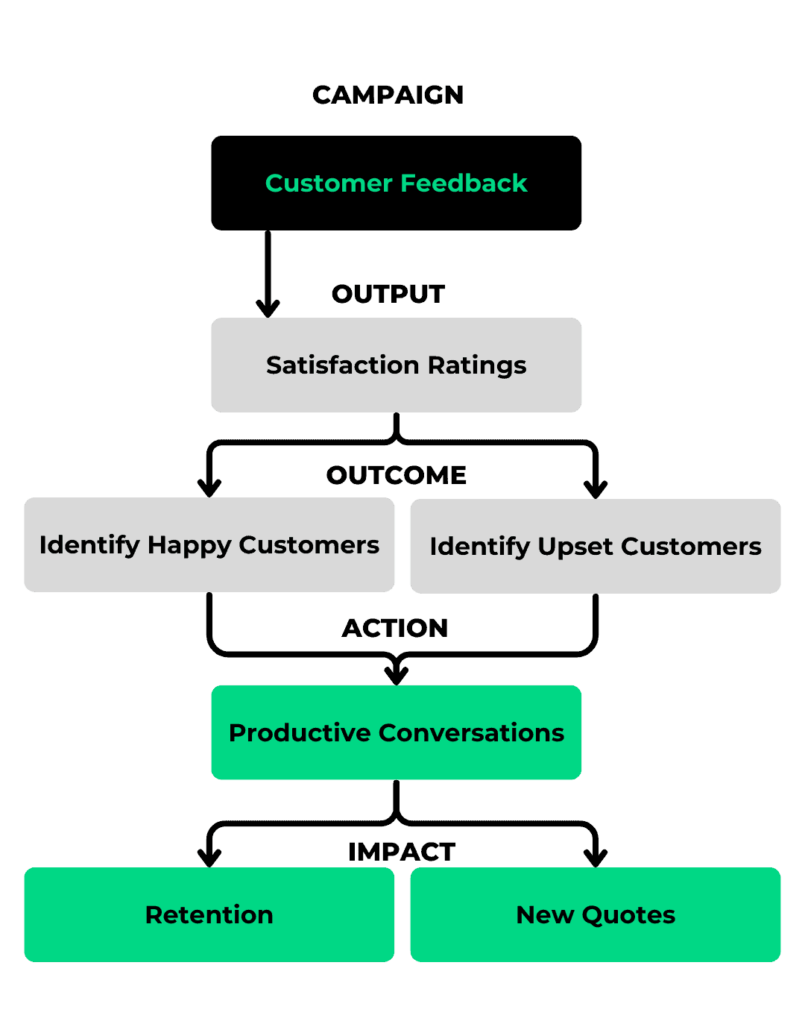

2. Customer Feedback Campaigns: Insights for Growth

A structured feedback campaign enables agencies to gauge client satisfaction and identify areas for improvement. By actively seeking feedback, you can:

- Recognize happy customers who may be open to policy upgrades, cross-selling, and referrals (new sales opportunities)

- Address concerns of dissatisfied clients, turning potentially lost customers into long-term, loyal ones (improve retention)

Both scenarios lead to meaningful conversations that can translate into increased revenue and customer retention.

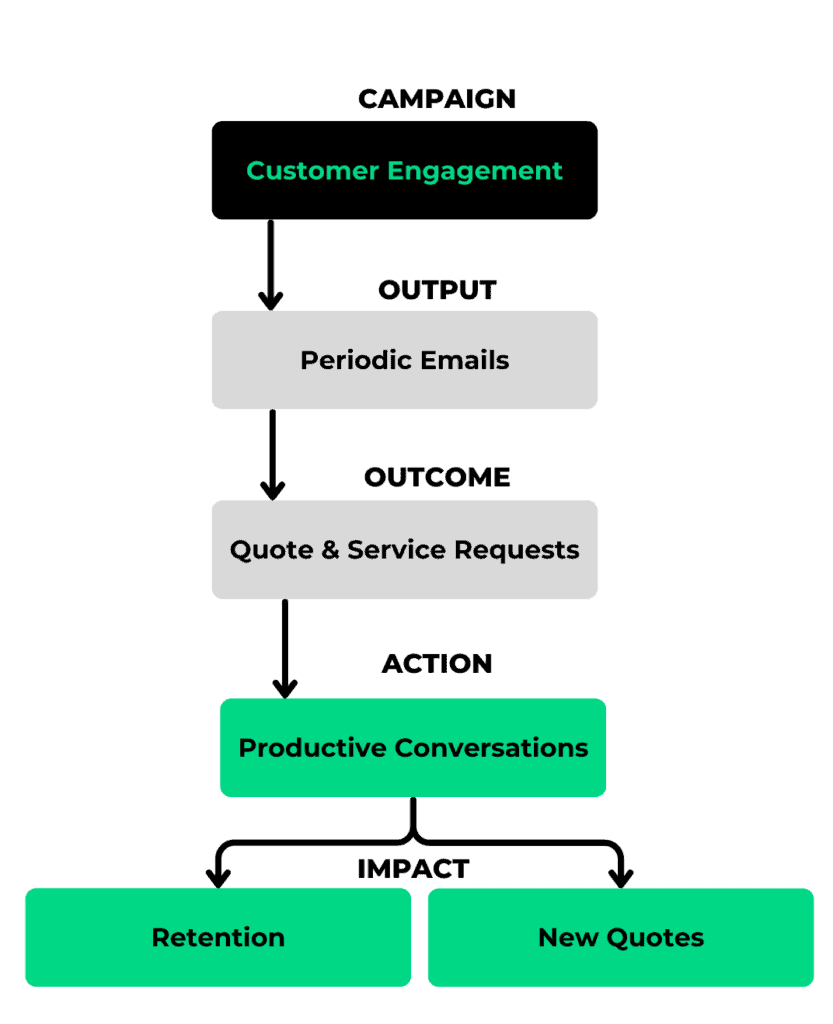

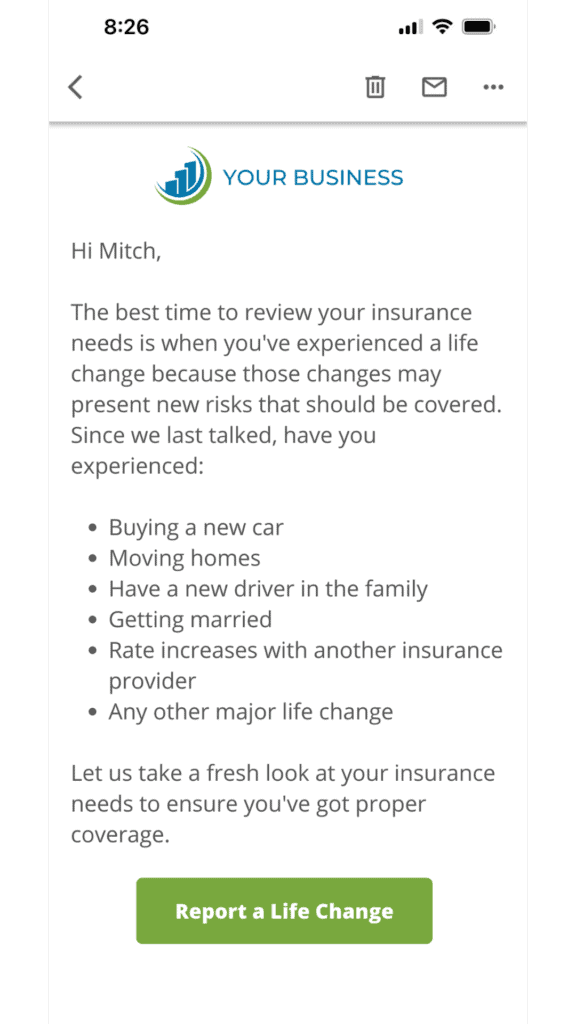

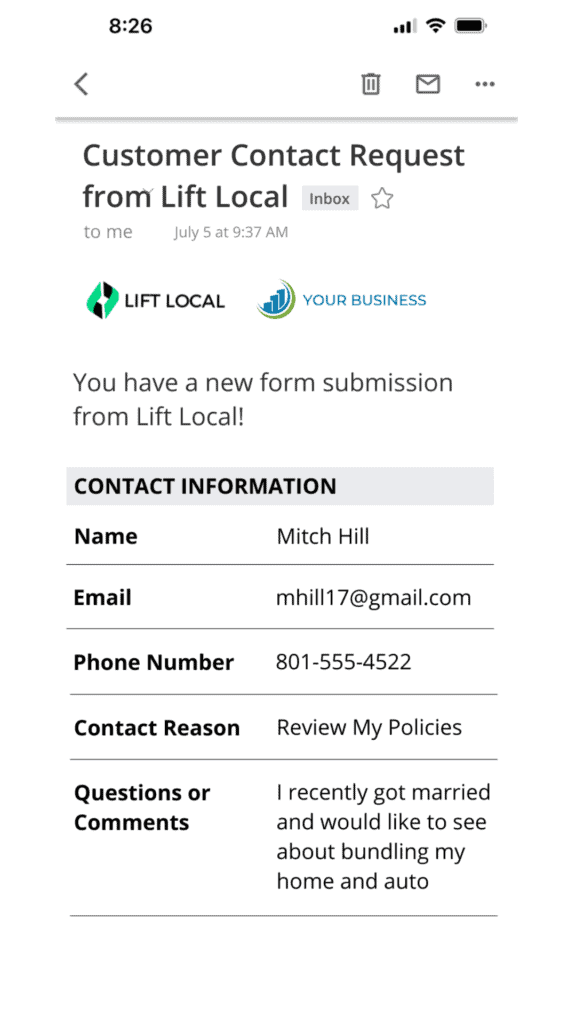

3. Customer Engagement Through Newsletters

Regular communication with clients via newsletters fosters engagement and builds trust. Providing valuable content, such as guidance on when to review insurance policies after life changes, invites customers to reach out. For instance:

- A client who recently got married may inquire about bundling home and auto insurance, creating a natural opportunity for a quote.

- A client concerned about a rate increase may reach out for clarification, allowing you to address their concerns and reinforce trust.

Each of these touchpoints enhances customer relationships while driving retention and policy growth.

Making Conversations the Centerpiece of Your Strategy

By shifting your marketing focus to facilitating productive conversations, your agency can unlock opportunities that might otherwise go unnoticed. Whether through digital marketing, customer feedback, or engagement campaigns, meaningful interactions provide a direct path to quoting new business and retaining existing clients.

Instead of merely chasing leads, insurance agencies should aim to cultivate an environment where conversations flow naturally and productively. Doing so will not only enhance customer satisfaction but also drive long-term success in an increasingly competitive industry.

Final Thought: The more quality conversations you generate, the more opportunities you’ll uncover. Make productive conversations the heart of your marketing strategy, and watch your insurance agency thrive.