Creating a comprehensive marketing plan is essential for the success of any insurance agency. A well-thought-out strategy ultimately leads to new sales and retention opportunities, which are both key to your agency growth. To help you craft your plan, here are five key questions to ask yourself.

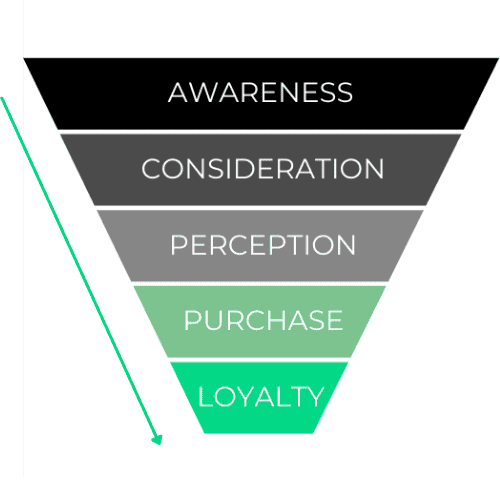

These 5 questions will walk you through each stage of the marketing funnel, and give you a starting point for brainstorming productive activities that you can include in your marketing strategy. By covering all your bases with these questions, you set your agency up for success.

1. How Can I Get My Message in Front of Potential Customers to Make Them Aware of My Brand?

The first stage of the marketing funnel is awareness. At this stage, the goal isn’t to generate leads but to ensure your brand becomes familiar to potential customers. This increases the likelihood that they’ll respond to lead-generating activities later.

Here are some examples of activities that enhance brand awareness:

- Send mailers to local households.

- Sponsor community events to show your involvement and support.

- Run social media ads targeting your ideal audience.

- Invest in billboard advertising to make your brand more visible.

These strategies will help your agency become more recognizable within your target market.

2. Where Do My Potential Customers Search for Solutions, and Am I Present in Those Places?

The next stage is consideration, where potential customers actively search for solutions. To be considered among their options, you need to ensure your presence in the right places.

Examples include:

- Partnering with local businesses: Collaborate with realtors or auto dealerships to exchange referrals, aligning with moments when people often think about insurance (e.g., buying a home or car).

- Improving local SEO: Make sure your agency appears in local Google searches by optimizing your website and ensuring accurate business listings.

Being present at the right time and place makes it easier for potential clients to include you in their decision-making process.

3. How Do I Stand Out From Competitors, and Why Should Potential Customers Pick Me?

In the perception phase, it’s crucial to differentiate your agency and build trust. Customers need to see why choosing you is their best option.

Here’s how to excel in this stage:

- Encourage positive Google reviews: A strong reputation online can significantly influence buying decisions.

- Enhance your branding: A professional online and social media presence helps convey credibility and appeal.

- Speak to your customers’ concerns: Address common questions and worries directly in your messaging.

By focusing on these areas, you’ll make your agency stand out and build confidence with potential clients.

4. How Can I Make It Easier or More Convenient for People to Contact Me, and Do I Have a Reliable Follow-Up Process?

The purchase phase is where potential clients decide to do business with you. Your job is to remove any barriers and ensure a seamless process.

Consider the following strategies:

- Create a high-converting website: Ensure your website is user-friendly and includes a quote tool for easy inquiries.

- Streamline follow-up processes: Respond promptly to leads and guide them toward finalizing a policy.

Making it easy for customers to take action increases the likelihood of closing sales.

5. What Can I Do to Build Relationships With Customers and Maximize Their Value?

The final stage, loyalty, focuses on retaining customers and increasing their lifetime value. Building strong relationships encourages repeat business and opportunities for upselling or cross-selling.

Here are some ways to foster loyalty:

- Host customer appreciation events: Show gratitude and strengthen connections.

- Conduct policy reviews: Identify opportunities to upsell or cross-sell additional coverage.

- Send satisfaction surveys: Gather feedback to improve your services and address client needs.

- Offer personalized gifts: Small tokens of appreciation can go a long way in building goodwill.

By nurturing these relationships, you can boost customer retention and profitability.

Final Thoughts

These five questions provide a structured approach to brainstorming an effective insurance agency marketing plan. By addressing each stage of the funnel, you’ll create a strategy that not only drives sales but also fosters long-term client relationships. Start brainstorming today, and watch your agency grow!