When it comes to insurance marketing, it can be daunting wondering where your next policy might come from. Should you buy a new list of leads to call? Invest in social media ads? Run a mailer? While keeping new leads coming into your pipeline is an essential part of running your agency, potential opportunities may be sitting right under your nose. Your existing lists of contacts can be a goldmine for your agency!

What is Contact Nurturing?

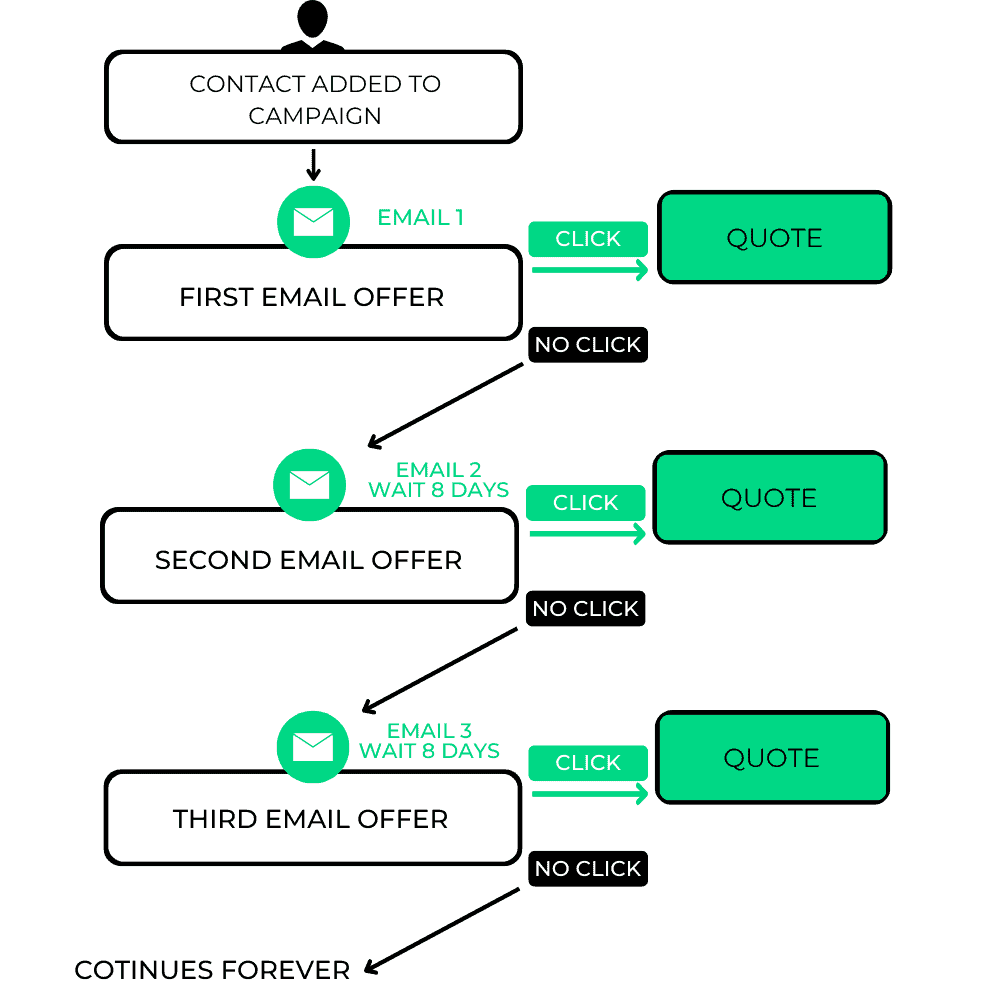

Contact nurturing is the process of using automated email campaigns to keep continuous contact with your prospects in the hopes of uncovering quote opportunities. The purpose is to send emails on a regular basis, even to contacts who may not be interested in your services right now. You should include a blend of genuinely helpful content and opportunities for your contacts to request a new quote.

At Lift Local, we run contact nurture campaigns for our clients. Over the course of about a year, campaigns sent to cold leads see an average of 2-3% of the leads request a quote, and 5-6% of former clients request an updated quote. If you have hundreds or thousands of cold leads or former customers at your agency, this could mean dozens of opportunities to start a conversation about new policies.

Why Should You Nurture Your Contacts?

1. Improve Your Contact Rates

If you have a few hundred, or even a few thousand contacts in your database, there are definitely opportunities to write new policies hidden somewhere in that list – from winning back former customers, to cross selling existing clients, to closing cold leads. The problem is, how do you identify the opportunities – how do you find the needle (quote opportunity) in the haystack (huge list of cold leads)?

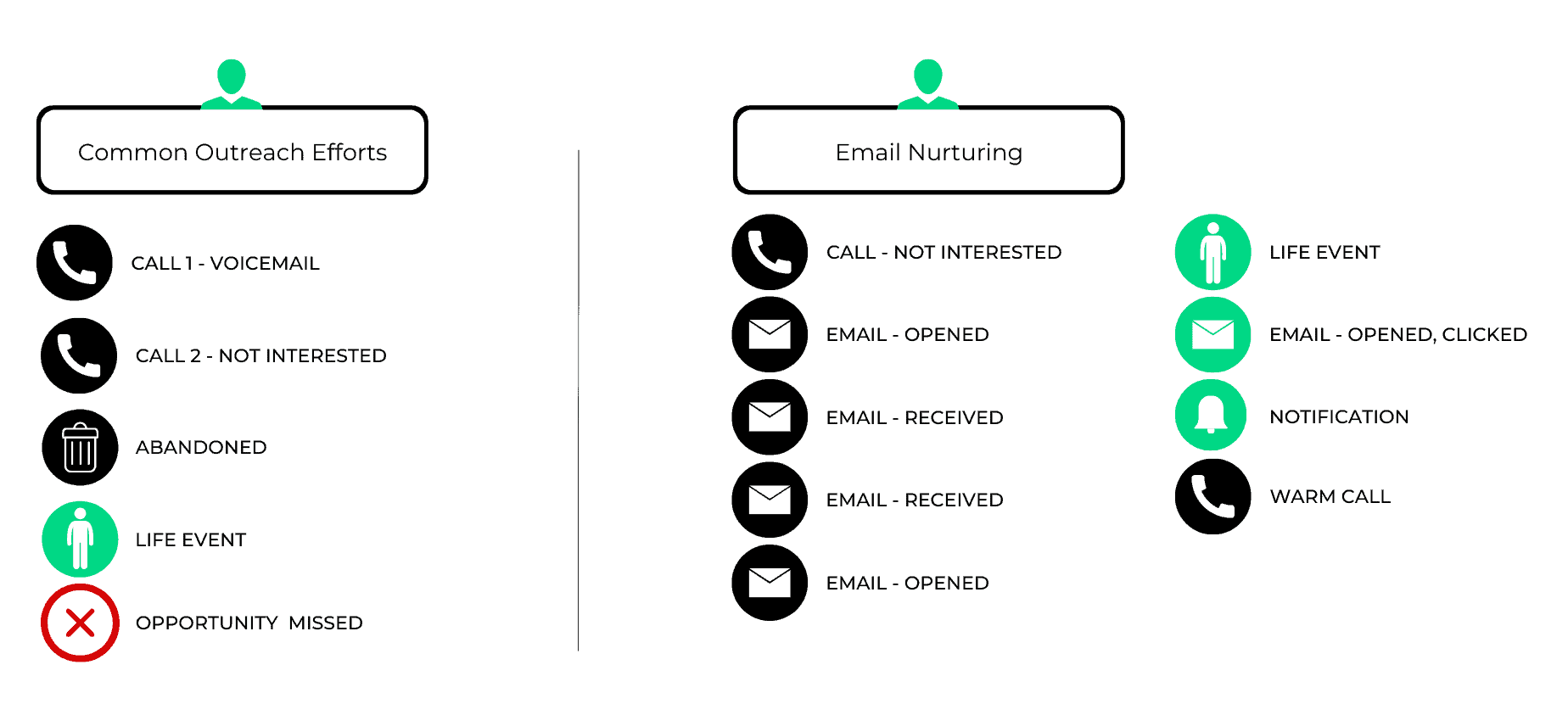

Lead nurturing improves your contact rates so that you can have conversations with more interested people. To achieve 1 touchpoint with each prospect on a large list by calling them would take weeks. With email nurturing, you can create a touchpoint with every contact in a matter of minutes, and it requires no effort on your part. The average lead requires 6-8 touchpoints with your brand before having a conversation, and email nurturing automates those touchpoints and ensures they are taking place even when you get too busy to call. These touchpoints are what uncover the quote opportunities.

2. Increase Your Brand Awareness

If your name is landing in your contacts’ inbox several times per month, they become familiar with your brand. When they know who you are and what you do, they’ll respond more positively when they hear your name on a voicemail, or when they stumble upon your listing on Google. When they think it’s time to look for a new quote, they’ll think of you. In short, they’ll get to know you, which will improve the success rates of all your other touchpoints, including future emails as you continue to nurture.

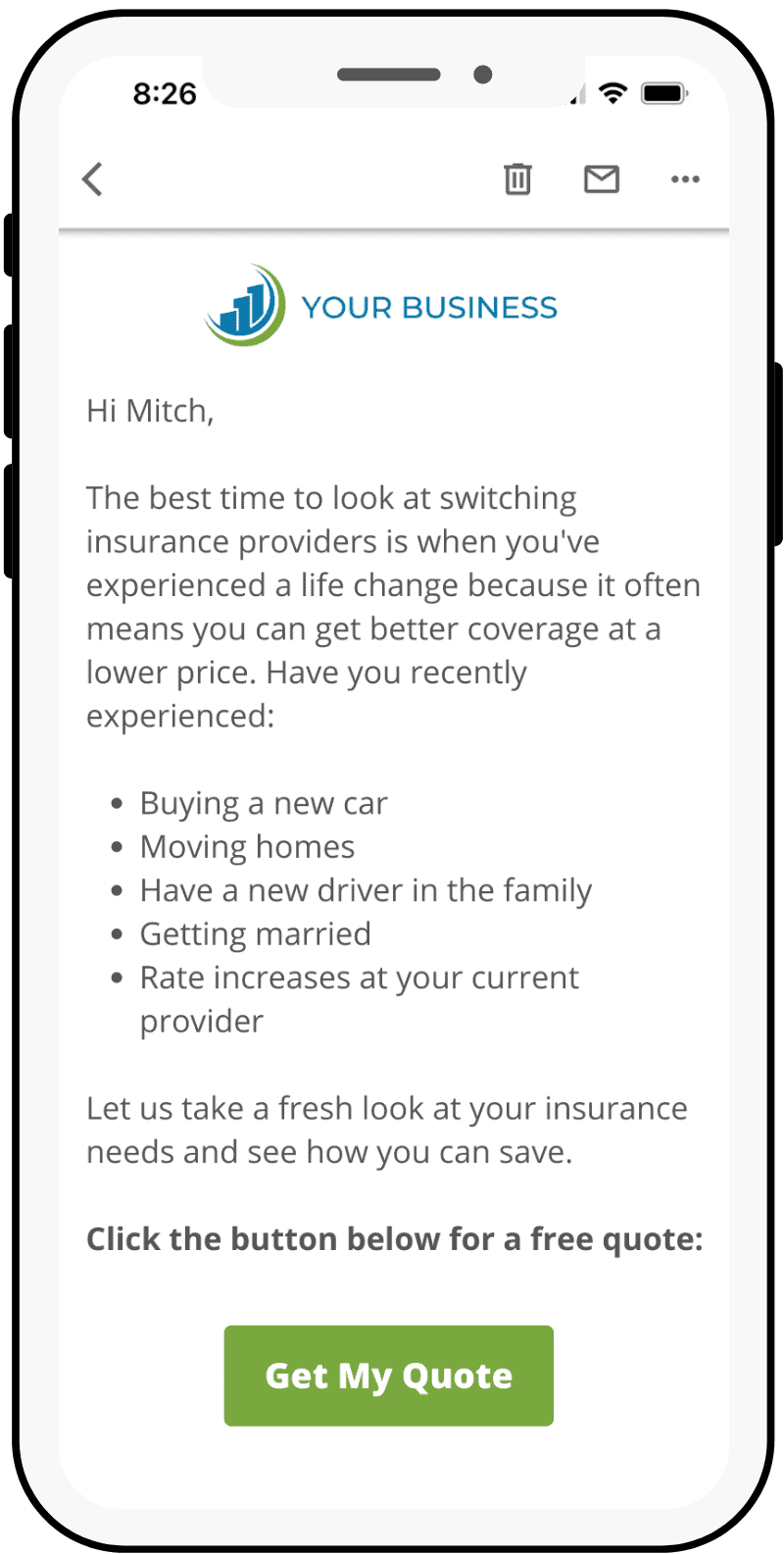

3. Be Present During Relevant Life Changes

Perhaps the most important reason to nurture your leads is that insurance needs change over time! Someone who told you a year ago that they weren’t interested in home insurance, for example, may be in the process of closing a house and have never been a hotter prospect! If you don’t contact them at the right time, how would you capitalize on that opportunity? Contact nurturing ensures that when the timing is right, you’ll be in the inbox with a relevant message or offer. Here are a few examples of when you’d want to be active in a prospect’s inbox:

A prospect has a new baby and is thinking about life insurance

A lead’s child just turned 16 and needs a new driver discount

A homeowner updated their basement and needs to check their home coverage

There are dozens of situations when a previously uninterested prospect suddenly becomes interested in a quote. Email nurturing ensures that you are always present in the inbox when that change happens. In the campaigns we run for our clients, it’s not uncommon for a contact to receive 50 or more emails with no engagement before finally requesting an updated quote. Why did this contact wait a year or more before showing interest? Because needs change over time!

Who Should You Nurture?

There is value in nurturing anyone you have contact information for. These usually fall into 3 buckets: Cold Leads, Current Customers, and Former Customers that you’d like to win back.

Cold Lead Nurturing

Cold Lead Nurturing

To nurture cold leads, you should brainstorm emails that explain why they might want to receive a quote from you. Some examples might include comparing their current pricing with what you can offer, reviewing their coverage to make sure they aren’t exposed to unnecessary risk, or life changes presenting new opportunities for pricing. The goal is to identify who is interested enough in a new quote to make it worth your time to call them specifically.

Customer Engagement

Nurturing your current customers has a slightly different objective. A study found that less than one third of insurance customers are satisfied with their provider. Either your customers don’t know who you are, or they do know but don’t really care. When cheaper pricing comes along, chances are many insurance customers don’t hesitate to leave their agent. You should email your current customers to give them a chance to get to know you, and to provide them with opportunities to request service or express dissatisfaction. You might send an email asking if they’d like a coverage review – this will help them get to know you, trust you, and maybe even uncover up-sell or cross-sell opportunities for you. An email introducing yourself and your staff could help customers feel a personal connection. These types of interactions can improve retention, both through a personal connection, and by bringing issues to your attention that you can fix.

Former Customer Winbacks

Nurturing former customers is a very similar process to nurturing cold leads. You want to provide opportunities for them to become familiar with your brand, while also offering a new quote. The difference is that you can throw in some personal touch since these contacts have already done business with you in the past.

Ready to Start Nurturing Contacts?

You can read about how to set up a nurture campaign yourself at this link. At Lift Local, we’ve helped hundreds of insurance agents nurture their contacts and start more conversations. We can handle all the content creation, automation, and list management necessary to run a successful campaign. If you’re ready to turn your dusty old lists into new conversations, let us know.