Renewals are the key to running a successful and profitable insurance agency. Unfortunately for agents, insurance has some of the highest customer acquisition rates of any industry. This is why winning back business is much easier than finding new clients to close. If you’re finding it challenging to get your previous customers back in the door, here are a few things you can do. Follow these steps in our guide, and learn how you can easily win back old leads and customers.

The Top Reasons Why Insurance Customers Cancel

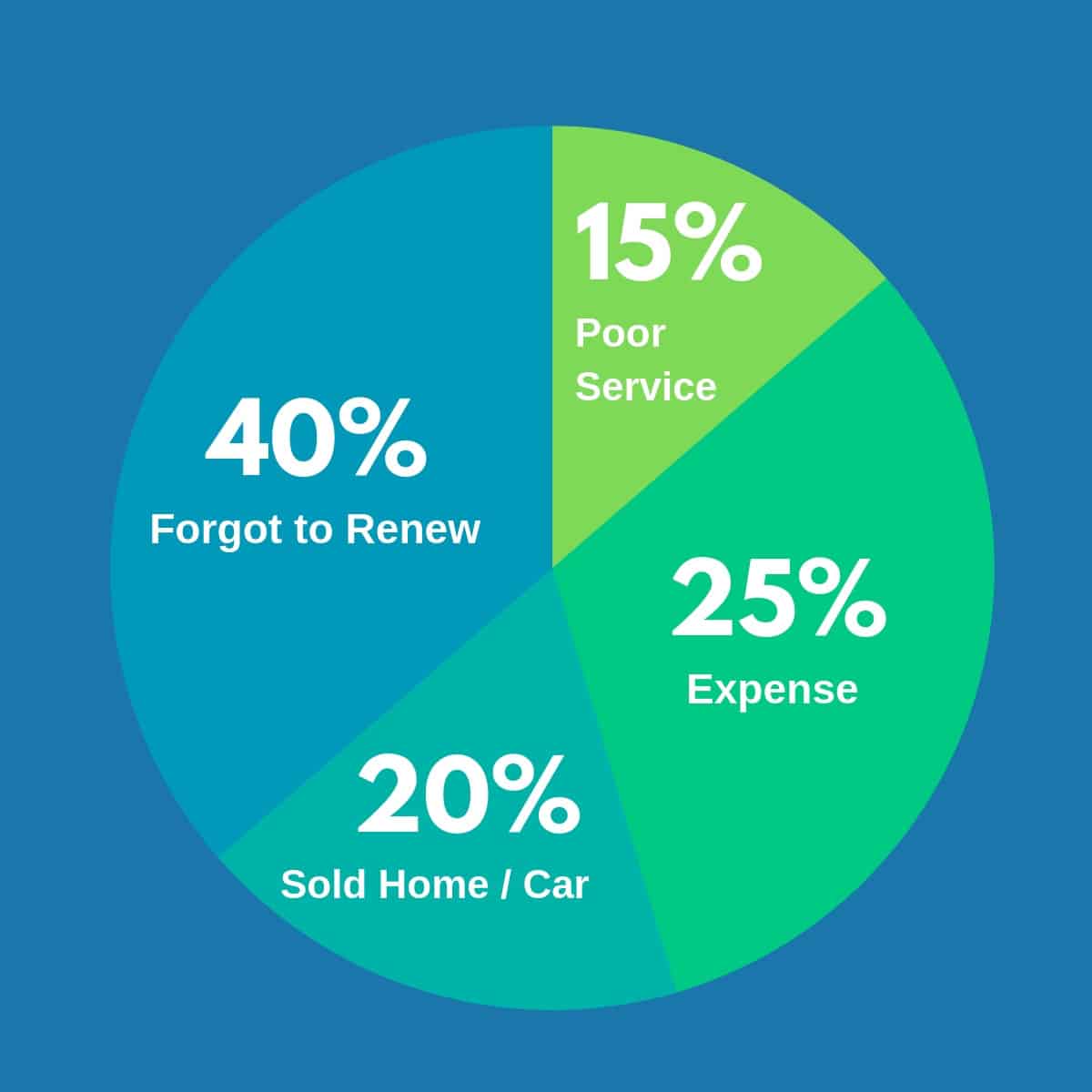

It’s important to know why your customers cancel their policies in the first place if you want to create an effective win-back campaign. Below are the most common reasons why insurance customers don’t renew with a particular agency.

- They had a bad customer service experience or a poor claim outcome.

Customer service is critical to running a successful business. If your customers have a terrible experience, they are more likely to cancel their policy and start doing business with your competitor. Fortunately, this is something within your power to control to a certain extent. Chances are, you won’t be able to change a bad claim outcome. But you can act as your client’s advocate with the insurance company and defend their best interests.

While it’s not always possible to get a claim approved, you can control customer service expectations and levels. Clients who don’t have a good claim outcome, but feel as if you and your agents went above and beyond to represent their interests, will remain loyal customers.

- The customer canceled because they found a less expensive rate.

If a customer leaves because they found a cheaper rate, there isn’t much you can do. While this can be incredibly frustrating for insurance agents, there is a way to prevent customers from leaving for less expensive policies. Cross-selling or multi-lining different policies are likely to keep customers from leaving for cheaper competitors. When a client has several lines of business at your agency, it becomes less advantageous and more complicated for them to move. Don’t be afraid to cross-sell homeowners or renters insurance when you close a new policy for auto.

- The customer sold the home or car you had insured for them.

This is a common reason why customers don’t renew their policy, and there is simply nothing you can do to prevent it from happening. Even though this reason for cancellation is beyond your control, it’s still critical that you know why a customer leaves your agency. Knowledge gives you the power to prevent cancellations from happening in the future and ensures that your agency stays in the black.

- They forgot to renew.

In some cases, clients can simply forget to renew their policies. People are busy, and it’s easy for them to forget about you if you don’t continue to touch base with them. Fortunately, this is something you can control. Send reminders for renewals, and use different advertising channels to keep in touch with your old customers and leads.

The Insurance Clients You Shouldn’t Try to Win Back

Unfortunately, some people are more trouble than they’re worth and can cost your insurance agency money in the long run. For many insurance agents, it’s important to know what types of clients aren’t worth the investment for a win-back campaign. Insurance agents who are new to the business may worry that they must try to retain every customer so they can keep their doors open and lights on. But bad clients can cost morale, energy, and ultimately, time and money. The types of clients you should let go when they cancel are:

- Problem clients who are never satisfied. These people can take up a lot of staff time and eat into your profit margins. Don’t be afraid to let them become your competitor’s problem.

- Clients whose policies repeatedly cancel due to non-payment

Study the Cancellation Process to Prevent Cancellations from Happening

Do you have a plan established for processing cancellations? Studying what happens during the cancellation process can give you insight into why people leave and if there’s anything you can do about it. Start documenting why people are leaving your insurance agency, and keep your notes and observations organized in one central place. Usually, your agency management system or CRM is a good place to store information.

In your CRM, set follow up reminders. Take note of when your customers’ policies are due for renewal. For example, if your client’s home insurance policy is set to renew annually, assign a follow-up reminder in eleven months. About one month before the policy, including multi-line policies, is set to renew is an ideal time to appoint a follow-up reminder for policies.

Create an Effective Win-back Process for Your Insurance Agency

Your agency management system, or CRM, will help you start the win-back process. Every month you’ll want to embark on a win-back campaign for your old customers, i.e., those clients whose policies are up for renewal in the following month. There are several ways you can manage a win-back campaign. Try using postcards and phone calls, email campaigns, and Facebook ads. If this all sounds a little too labor intensive, we actually offer a win-back service at Lift Local.

The Post Card and Phone Call Win-back Strategy

Step one is to send a postcard in the mail to remind the client that their policy is up for renewal. Ask them to place a phone call to your agency to get a new quote on their insurance. But the key here is to not wait for them to call you. Give them a little time to receive the postcard. Then contact them over the phone. Ask if they got the card, and then give them the relevant quote information. Can’t get a hold of them via phone? Don’t be afraid to follow-up. Send them an email next!

With this win-back strategy, you have the chance to get in touch with your former customers without coming across as pushy. And when you create an automated system for follow-ups in your CRM, you can plan your renewal reminders in bulk, saving time and money and making it easier for your team to process the renewals.

What should you say in the postcard? Tell the client that their policy is up for renewal, and you’d love to give them a new quote. If you have discounts or new rates to offer, be sure to mention that on the postcard as well.

Email Campaigns Win-back Strategy

The problem with many win-back emails is that they aren’t personalized. Personalization can go a long way towards enticing old customers to renew their policies with you. When sending emails to win-back customers, it is essential to customize them. Be sure to address the person by name in the email subject line and throughout the body of the email. Mention the specific policies the person has up for renewal. In general, you can use similar copy in the email that you would put in a postcard. Whatever you do, don’t use an impersonal, email template that doesn’t address the client by name and their specific policies or concerns.

Also, use the email to speak to the customer’s specific needs, or mention something personal to that client that you can remember from your last interaction. Was their child graduating from high school, or did they move to the area? Mention it and ask how they are doing. Also, if your client has had a bad service experience or poor claim outcome, speak to that in the email. Customers with poor experience won’t respond favorably to a “we miss you” renewal email.

The Facebook Ads Win-back Strategy for Insurance Agents

Social media marketing, especially through Facebook, is an excellent way to win back clients for B2C companies in particular. One way to touch base with old customers and win-back your clients is with targeted Facebook ads. If you have your clients’ email addresses, you can upload a CSV file of their emails into Facebook. This allows you to show advertisements directly to those people when they’re using Facebook. You can also target your people who are up for renewal with win-back Facebook ads in the month leading up to their policy expiration. Check out the graphic below for an easy guide to starting a basic Facebook ad.

Best of Luck!

Can you use all of these strategies at once? Yes, it’s possible to use all three of these win-back strategies simultaneously. In fact, it’s probably a good idea that you use all marketing channels at your disposal for win-back campaigns. When people see you in their email inbox, their actual mailbox, their call logs, and their Facebook feeds, it’s hard for them to miss you and forget about your agency. It also shows that you are working hard to keep their business, and it can help cement trust and customer loyalty in your client back. Keep these tips and strategies in mind for winning back your old customers and leads for your insurance agency. As always, feel free to reach out to us with any questions! Our win-back experts would love to help!